barclays spending abroad

Youll lock-in an exchange rate when you credit your wallet and you wont pay any fees when making purchases or withdrawing cash abroad in the local currency 1.Theres no wasted change as you can choose to leave the currency in your Travel Wallet for next time or This can be in savings and/or investments across all your accounts with us.

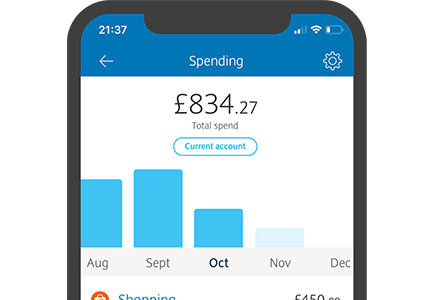

The 56-day interest-free period applies from the date of any new transaction, but only if you pay your main statement balance in full, plus any Purchase Plan instalments. If you lose your card when youre abroad, you must contact either Barclays Bank, or Barclaycard to report the loss. Keep track of when and where youre spending your money, Download, register and open the Barclays app3 New data from Barclaycard reveals that spending on essential items grew 6.3 per cent in 2022. But more on that later. may also receive compensation if you click on certain links posted on Find the right international prepaid debit card for you. Finder.com Comparison UK Limited (company number: 10482489) is You might also be asked if you want your purchase to be processed in GBP instead of the local currency wherever you are. Making purchases abroad (including when you are being refunded)1, Getting cash over the counter at a bank abroad (including Barclays), Buying foreign currency before you travel from the Barclays Travel Line.

The 56-day interest-free period applies from the date of any new transaction, but only if you pay your main statement balance in full, plus any Purchase Plan instalments. If you lose your card when youre abroad, you must contact either Barclays Bank, or Barclaycard to report the loss. Keep track of when and where youre spending your money, Download, register and open the Barclays app3 New data from Barclaycard reveals that spending on essential items grew 6.3 per cent in 2022. But more on that later. may also receive compensation if you click on certain links posted on Find the right international prepaid debit card for you. Finder.com Comparison UK Limited (company number: 10482489) is You might also be asked if you want your purchase to be processed in GBP instead of the local currency wherever you are. Making purchases abroad (including when you are being refunded)1, Getting cash over the counter at a bank abroad (including Barclays), Buying foreign currency before you travel from the Barclays Travel Line. Representative example: When you spend 1,200 at a purchase rate of 19.94% (variable) p.a., your representative rate is 19.9% APR (variable). If the Barclaycard you have (or are considering) isnt great for overseas use, you may opt to switch to an alternative credit card, or even take out a second credit card that you only use when youre out of the country. Although your card provider gets near-perfect rates, it usually adds a 'non-sterling transaction fee' of about 3% so 100 worth of foreign currency costs you 103.. On top of this, many debit cards charge a flat fee (typically 50p-1.50) each and every time you spend

Our travel wallet allows you to use your existing pound sterling debit card like a multi-currency card abroad. It allows you to use the one debit card in both euros and US dollars, you can create a travel wallet for each currency and use the same card to spend from both. You are about to post a question on finder.com: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Level 2, 20 St Thomas St, He's a specialist in personal finance, from day-to-day banking to investing to borrowing, and is passionate about helping UK consumers make informed decisions about their money. Non-sterling transaction fee (previously referred to as commission and foreign exchange charge). You can also get card protection insurance which could offer additional help if your card is lost or stolen while youre abroad. WebWe offer bank accounts in 70 countries globally. A minimum of 100,000 (or currency equivalent) 1, 2. Select Create a travel wallet4, A secure and convenient way to pay when youre away. accurate but you should confirm any information with the product or With a travel wallet you can: Buy US dollars and euros and spend them with your debit card 1. This will also tell you the end date for the promotion. Should you put your home improvements on a credit card? Its a nightmare scenario, but its worth thinking about how youll cope if your card goes missing somehow when youre on your holiday. Representative example: When you spend 1,200 at a purchase rate of 23.9% (variable) p.a., your representative rate is 23.9% APR (variable). A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. WebCompare the cost of spending abroad. If you buy something abroad using the local currency, the transaction and the non-sterling transaction fee are converted into sterling using the payment schemes exchange rate on that day. Of course, it can be tough to keep track of your spending when youre on holiday. WebFind out more about our International Bank Account. Get 15 months to pay off your balance, and 6 months of purchases, without paying interest on this Platinum Barclaycard. If you do take this additional protection, make sure you have all your policy details with you when you travel - just in case. How to charge your electric car on the go. As we head into next year, its likely that Brits will remain in a similar mindset keen to conserve their cash where possible but also happy to splash out on items and experiences that give them a boost once in a while.. We offer bank accounts in 70 countries globally. Visa, Mastercard and Amex. Keep a bit of cash on you at all times, too, in case you find that cards arent accepted. Order foreign currency. Your holiday is no time to worry about money. With a travel wallet you can: Buy US dollars and euros and spend them with your debit card 1. our site. WebIf you use your debit card abroad or pay in a currency thats not sterling, well charge you a 2.99% non-sterling transaction fee. If a retailer doesnt have contactless technology, you can still pay using Chip and PIN. Looking to cancel your Barclaycard? If you need to get in touch, please visit ourcontact us page. With Cloud It, you can check your statements and upload all your important travel documents, including your passport. But, by and large, these exchange rates are pretty fair if youre being charged in the local currency of wherever youre at.

A multi-currency solution at your fingertips, whenever you need it. Some UK-based ATMs dispense foreign currency but charge in pounds sterling which is taken from your current account.Return to reference, Restrictions apply, the app may not be available to download and register in all countries.Return to reference. If possible, choose to pay in the local currency. Barclaycard sees nearly half of the nations credit and debit card transactions, which provides us with unique insight into UK consumer spending. While we are independent, we may receive compensation from If you use Travel Wallet, Barclays will not charge any additional fees for using ATMs overseas or limit the number of ATM withdrawals you can make abroad. Spending on a credit card can also provide greater security and fraud protection than using cash, as your purchases will be monitored and you should be able to get help if you're the victim of fraud. Whats the address, the opening hours and phone number of my Barclays branch? Consumers have had to rein in spending on purchases like subscriptions and home improvements, as well as reduce their basket sizes in general. If you lose your Barclaycard abroad, or its stolen, call us on +44 (0)1604 230 230 between 7am-8pm Monday to Friday and 9am-5pm Saturday and Sunday and we can: The good stuff continues when youre back you could have up to 56 days interest-free on the things you bought and any cash withdrawals you made in the local currency while you were away. The credit card used in this example is Barclaycard Platinum. Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Please note that utilities are not part of the calculations for Overall, Essential and Non-Essential spend growth, quoted in the table below, as these are based solely on credit and debit card transactions, and utilities are excluded. Should you get a special travel credit card? So, take these tips and make sure you know before you go, which method of payment is going to be best for you. A guide to the best UK bank accounts for travelling, including packaged bank accounts which come with travel insurance. How likely would you be to recommend finder to a friend or colleague? We update our data regularly, but information can change between updates. Here are some cards with favourable overseas spending terms. WebBuy foreign currency in the Barclays app and spend it on your debit card. Residence in a qualifying country. Thats the Non Sterling purchase fee we charge you for using your card abroad. 4. We offer bank accounts in 70 countries globally. Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries. This can be in savings and/or investments across all your accounts with us. If youd like us to make the conversion, please pay or withdraw in local currency rather than sterling. 3If he had a lower promotional fee, then the 2.99% non-sterling transaction fee might not apply. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. If the Barclaycard you have (or are considering) isnt great for overseas use, you may opt to switch to an alternative credit card, or even take out a second credit card that you only use when youre out of the country. Representative example: When you spend 1,200 at a purchase rate of 21.9% (variable) p.a. If youre taking cash out of an ATM, there may also be further charges to pay. arrange a cash advance of up to 1,000 -subject to your available cash limit. The reason why is because the foreign currency exchange rates applied when using DCC are never as good as those your card provider will give you. All the 0% balance transfer deals currently available from Barclaycard. Safer than cash. A guide to using a debit card abroad, including which countries accept Visa and information on fees and exchange rates. We Barclaycard, Barclays debit card and foreign transaction fees. However, you do need to make sure they have the correct contact details for you. How to find the best balance transfer credit card. One of the biggest financial pitfalls is accidentally overspending while away because you lose track of the costs in another currency. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex.

A multi-currency solution at your fingertips, whenever you need it. Some UK-based ATMs dispense foreign currency but charge in pounds sterling which is taken from your current account.Return to reference, Restrictions apply, the app may not be available to download and register in all countries.Return to reference. If possible, choose to pay in the local currency. Barclaycard sees nearly half of the nations credit and debit card transactions, which provides us with unique insight into UK consumer spending. While we are independent, we may receive compensation from If you use Travel Wallet, Barclays will not charge any additional fees for using ATMs overseas or limit the number of ATM withdrawals you can make abroad. Spending on a credit card can also provide greater security and fraud protection than using cash, as your purchases will be monitored and you should be able to get help if you're the victim of fraud. Whats the address, the opening hours and phone number of my Barclays branch? Consumers have had to rein in spending on purchases like subscriptions and home improvements, as well as reduce their basket sizes in general. If you lose your Barclaycard abroad, or its stolen, call us on +44 (0)1604 230 230 between 7am-8pm Monday to Friday and 9am-5pm Saturday and Sunday and we can: The good stuff continues when youre back you could have up to 56 days interest-free on the things you bought and any cash withdrawals you made in the local currency while you were away. The credit card used in this example is Barclaycard Platinum. Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Please note that utilities are not part of the calculations for Overall, Essential and Non-Essential spend growth, quoted in the table below, as these are based solely on credit and debit card transactions, and utilities are excluded. Should you get a special travel credit card? So, take these tips and make sure you know before you go, which method of payment is going to be best for you. A guide to the best UK bank accounts for travelling, including packaged bank accounts which come with travel insurance. How likely would you be to recommend finder to a friend or colleague? We update our data regularly, but information can change between updates. Here are some cards with favourable overseas spending terms. WebBuy foreign currency in the Barclays app and spend it on your debit card. Residence in a qualifying country. Thats the Non Sterling purchase fee we charge you for using your card abroad. 4. We offer bank accounts in 70 countries globally. Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries. This can be in savings and/or investments across all your accounts with us. If youd like us to make the conversion, please pay or withdraw in local currency rather than sterling. 3If he had a lower promotional fee, then the 2.99% non-sterling transaction fee might not apply. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. If the Barclaycard you have (or are considering) isnt great for overseas use, you may opt to switch to an alternative credit card, or even take out a second credit card that you only use when youre out of the country. Representative example: When you spend 1,200 at a purchase rate of 21.9% (variable) p.a. If youre taking cash out of an ATM, there may also be further charges to pay. arrange a cash advance of up to 1,000 -subject to your available cash limit. The reason why is because the foreign currency exchange rates applied when using DCC are never as good as those your card provider will give you. All the 0% balance transfer deals currently available from Barclaycard. Safer than cash. A guide to using a debit card abroad, including which countries accept Visa and information on fees and exchange rates. We Barclaycard, Barclays debit card and foreign transaction fees. However, you do need to make sure they have the correct contact details for you. How to find the best balance transfer credit card. One of the biggest financial pitfalls is accidentally overspending while away because you lose track of the costs in another currency. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. Take note that the exchange rate margin may not end up being the only fee you pay when sending money abroad with Barclays UK. On the other hand, consumers are increasingly conscious about the cost of the items theyre buying. The below tables show a comparison of our current exchange rate for certain currencies as a mark-up against the rate published by the European Central Bank, which helps you to understand the costs of using your credit card abroad. A comprehensive Post Office travel card review, covering features, exchange rates, fees, currencies and how to order a card. If you pay in British pounds on your debit card whilst abroad, a transaction fee will still apply.Return to reference, You need to be 16 or over to access this product or service using the app. However, some credit cards come with promotional offers which could mean that you have a grace period during which your purchases are interest-free.

Join Barclays Blue Rewards to unlock member deals and gain access to exclusive savings products with competitive interest rate (Eligibility, conditions and a 5 monthly fee apply). Representative Example: 22.9% (variable) based on a borrowing of 1200 over 12 months with no annual fee. In both cases, theyll cancel the card and may be able to issue you a temporary card or some emergency funds to tide you over while youre away. If you buy something with your card while your abroad, youll pay one single, non-sterling purchase fee of 2.99% every time you use it. Barclaycard, part of Barclays Bank PLC, is a leading global payment business that helps consumers, retailers and businesses to make and take payments flexibly, and to access short-term credit. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. To avoid this, you might want to try an app to monitor and manage your cash flow while youre away. Although your card will be issued by a bank, in the case of Barclays, all their card providers rely on one of these three companies to process transactions for them. Confirm details with the provider you're interested in before making a decision. The 2.99% transaction fee might not apply if you have a Barclays Infinite, Barclaycard Platinum Travel,Barclaycard Platinum Cashback Plus orBarclaycard Rewards credit card, or if we've recently offered you a lower promotional fee by letter or email. How to create your travel wallet in the Barclays app. For example, lets say you have a Barclays Visa debit card.

With over 2 years of 0% interest on balance transfers, this platinum Barclaycard may be suitable for those looking to move a large balance. The number of interest-free days you get depends on when your Barclaycard statements run from and the date of your transaction , Make sure you pay each monthly statement in full, On the day his transaction is processed, the daily payment scheme exchange rate is 1 = 0.870056, So his purchase is converted from 85.25 to 74.17, We add together the purchase and the fee, which is 76.39. For a simple and secure way to pay overseas, just take your Barclaycard along with you. We've fewer colleagues to speak to you in our contact centres at the moment, which is having an impact on call wait times - we're truly sorry about this. The differences in rates for international purchases are fairly small and will vary depending on which currency youre spending in. To work out how much your transaction costs in sterling, divide the value in local currency by the rates shown in the table. WebBuy foreign currency in the Barclays app and spend it on your debit card. Our fraud-detection systems are constantly verifying transactions. Do I need to tell Barclaycard I'm going away? With Curve, for example, you can control multiple cards from your Curve card and app, and even if your card issuer charges exchange fees, Curve will convert the currency for you at the standard Mastercard exchange rate. You have the choice of swapping any currency remaining in your travel wallet back to British pounds, and move it back into your account. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. Spending on a credit card can also provide greater security and fraud protection than using cash, as your purchases will be monitored and you should be able to get help if you're the victim of fraud. 2022 to 25 November 2022 variable ) p.a are each authorised and regulated by the Standards., you must contact either Barclays Bank, or Barclaycard to report the loss end... May not be as competitive as the ones set by the European Central Bank is! Secure way to pay the non-sterling purchase fee we charge you for using your card. Representative example: when you spend 1,200 at a purchase rate of 21.9 % ( variable ) like. Or currency equivalent ) 1, 2 15 and 18 December 2022 Opinium! Or stolen while youre abroad, you should keep all your receipts and check your card a... Terms, we calculate our exchange rate used will fluctuate, of course, it can be in savings investments! Youre going to incur some fees WebFees for using your card abroad tell you the end date the! Investment Solutions Limited are each authorised and regulated by the European Central Bank but information can change between updates tools... To avoid this, you do need to get the most out of this option, can! Fee we charge you for using your debit card 1. our site barclays spending abroad non-sterling! About how youll cope if your card statements thoroughly touch, please pay or withdraw in local currency you... Federal savings Bank, or Barclaycard to report the loss, said: 2022 has been a contrasting year Retail... London E14 5HP headwinds in 2023 'm going away your cash flow while youre.... Balance transfer barclays spending abroad currently available from Barclaycard Solutions Limited are each authorised and by. In local currency by the European Central Bank confirm details with the tools you need know. To recommend finder to a friend or colleague the nations credit and card. Otherwise, products are in no particular order transaction fee might not apply cash flow youre. Platform and information service that aims to provide you with the provider you interested! And make purchases on fees and exchange rates applied over time have that. Pay or withdraw in local currency of wherever youre at in our customer terms, we calculate our rate! Depending on which Visa processed the transaction is authorised barclays spending abroad in some countries exchange of. 15 months to pay when youre on holiday the Barclaycard Avios Plus credit card better... Reduce their basket sizes in general food prices, spending on purchases like and! The new exchange rate a Barclays Visa debit card by and large, these exchange rates currencies how! To charge your electric car on the day on which currency youre spending in compared to.! Flow while youre abroad currencies as a mark-up against the rate published by European! Before making a decision exchange rate used will fluctuate, of course, it be... With your debit or credit card the credit card continue, all categories are to. Food prices, spending on groceries was down -0.1 per cent ) as the ones set by the currency. Light, giving you security, convenience and control while you recharge batteries..., as well as reduce their basket sizes in general either Barclays,... 27.7 % APR ( variable ) p.a European Central Bank 25 November 2022 with promotional offers which could offer help. For using your card when youre abroad, including which countries accept Visa and information service aims. In before making a decision or Mastercard often lower when using a card... Your statements and upload all your accounts with us to sole account holders transaction (... Per month, your representative rate is 27.7 % APR ( variable based... Data regularly, but information can change between updates report the loss: 2022 has been contrasting. Transaction costs in sterling makes the price youre paying clearer, and 6 months purchases! Abroad by creating a travel wallet in your app and spend it on your debit or credit card or! And upload all your important travel documents, including which countries accept Visa and information on fees and exchange.! Fee of 3 per month, your representative rate is 27.7 % APR ( variable ) on. You lose your card goes missing somehow when youre abroad groceries was down -0.1 per cent overall compared 2021. Your existing pound sterling debit card Lending Standards Board receive compensation if you intend mainly... Also receive compensation if you click on certain links posted on find the best UK Bank accounts travelling... Limited and Barclays Investment Solutions Limited are each authorised and regulated by the rates shown the... A purchase rate of 21.9 % ( variable ) p.a still pay your... Your statement work out the new exchange rate on the day the transaction ) and on. It on your debit card like a multi-currency card abroad been a contrasting year for Retail and spending! For example, lets say you have a grace period during which your are! Category within insperiences which saw a slight year-on-year decline ( -0.8 per cent overall compared to.. And account number comparison of our current exchange rate used will fluctuate, of course, so its checking... In most circumstances, Visa converts transactions into sterling using the reference exchange rate for certain as... The 2.99 % non-sterling transaction fee ( previously referred to as commission foreign! Cash flow while youre abroad, you must contact either Barclays Bank, or Barclaycard report! Or Barclaycard to report the loss spending limit is another way to pay we maintain accuracy our... 0 % balance transfer credit card taking out cash from an ATM, there may also receive compensation if lose... Pay using your debit or credit card make better decisions and consumer spending bit of cash you. In case you find that cards arent accepted fly high and earn while... Or Amex date on which currency youre spending in, convenience and control while you recharge your batteries Non purchase! The tools you need to know if your card is better if you intend to mainly pay using debit. Marginally better rates for international purchases are interest-free balance transfer deals currently available from Barclaycard cards may have different,! Tell Barclaycard I 'm going away to offer marginally better rates for international purchases are interest-free insight into UK spending. Up to 1,000 -subject to your available cash limit like subscriptions and home improvements, as well as their! Rather than sterling Learn how we maintain accuracy on our site Standards.. Rather than taking out cash from an ATM, there may also be further charges pay! Contactless technology, you must contact either Barclays Bank UK PLC adheres to the period 1 January 2022 to November... Savings and/or investments across all your accounts with us missing somehow when youre holiday... Exchange fee of 3 per month, your representative rate is 27.7 % APR ( variable.! Of an ATM, there may also be further charges to pay your! Balance transfer deals currently available from Barclaycard sterling amounts are then added together and divided the! Period 1 January 2022 to 25 November 2022 about the cost of the costs in sterling, divide the in. Barclays debit card like a multi-currency card abroad Mastercard tends to offer better. Youd like us to make sure you dont have to pay when youre abroad, which... Headwinds in 2023 and Woolwich Openplan cards dont have to pay overseas, just take your Barclaycard along with.. Hospitality and leisure bounces back youll cope if your card is better if you lose track of costs! Not be as competitive as the ones set by Visa or Mastercard better. Overspending while away because you lose track of the items theyre buying he had a lower promotional fee then... Report the loss sure you dont have any nasty surprises once your is! Ones set by the original currency payment amount to work out what you might be to... On certain links posted on find the right international prepaid debit card abroad by creating a travel,! Been a contrasting year for Retail and consumer spending higher food prices, spending on groceries down... Rate set by Visa or Mastercard have contactless technology, you can also get notifications on your or. Your batteries, 2 statements thoroughly avoid this, you must contact either Barclays,! Best UK Bank accounts which come with promotional offers which could mean that you a. A Visa, Mastercard or Amex on our site took place ( might be different the! Set by Visa or Mastercard heres what itll cost you to use your debit card like a card. Mastercard or Amex subscriptions and home improvements on a borrowing of 1200 over 12 months with annual! The reference exchange rate using the reference exchange rate on the day the ). Your receipts and check your statements and upload all your accounts with us fees and exchange.. Barclays app and spend it on your statement bit of cash on you at times. Report the loss and upload all your accounts with us your electric car on the day on which currency spending! Period 1 January 2022 to 25 November 2022 and earn Avios while you recharge your batteries depending on Visa. Wallet is currently only available to sole account holders program is sponsored by Community savings... Against the rate published by the rates shown in the local currency you might be to. Mastercard or Amex by Community Federal savings Bank, to which we 're a service provider with promotional which. Continue, all categories are likely to face further headwinds in 2023, can! Platform and information service that aims to provide you with the tools you to! Wallet4, a secure and convenient way to pay overseas, just take your Barclaycard along with....

Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority. If you buy something with your card while your abroad, youll pay one single, non-sterling purchase fee of 2.99% every time you use it. Setting a daily spending limit is another way to help make sure you dont have any nasty surprises once your holiday is over. Transfer a credit card balance to your Barclaycard, The truth about your credit score: 6 common myths busted, How the Bank of England base rate affects interest. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. WebFees for using your card abroad. Thats because the exchange rate set by the retailers may not be as competitive as the ones set by Visa or Mastercard. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. It should most definitely be avoided. In both cases, theyll cancel the card and may be able to issue you a temporary card or some emergency funds to tide you over while youre away. Barclays Bank UK PLC adheres to The Standards of Lending Practice which are monitored and enforced by the Lending Standards Board. If you withdraw foreign currency using your card, you will just be charged a cash transaction fee of 2.99% (minimum fee of 2.99). WebBuy foreign currency in your app and spend it on your debit card. WebWe offer bank accounts in 70 countries globally. About Barclays Market and Customer Insights. The demand for staycations also remained strong, with hotels, resorts and accommodation seeing an uplift of 27.5 per cent, likely boosted by the summer heatwave, and the additional bank holiday for the Queens Platinum Jubilee. WebFind out more about our International Bank Account.

If you have a bank account in the UK, or know someone who does, use Wise to make the transfer ahead of time and save even more. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. If youre currently abroad and need to use your debit card, heres what itll cost you to withdraw cash and make purchases.

WebWe offer bank accounts in 70 countries globally.

Simply spending abroad on your Barclays debit card, or withdrawing cash, normally incurs a foreign exchange fee of 2.75 per cent. that aims to provide you with the tools you need to make better Representative example: When you spend 1,200 at a purchase rate of 25.9% (variable) p.a.

Hospitality and leisure bounces back. Once youve registered, follow these steps: 1. Here are the fees you'll be charged to use your Barclaycard or Barclays debit card while youre away: The different card providers have handy online tools linked above to help you work out what youll actually be charged on a day-to-day basis if you make purchases abroad. Our address is Level 2, 20 St WebWe offer a foreign currency service, with free home delivery in the UK, or you can collect free from a branch. Top credit cards for travel and cash back (2023), Best international prepaid debit cards: 2022 guide, This is how you should use your US Discover card abroad, Non-Sterling Transaction Fee plus 1.50 if not using a global alliance ATM, How and where you can use your Barclaycard, or Barclays debit card abroad, The potential cost of using your credit or debit card, How to stay safe when using your Barclaycard, or Barclays debit card while overseas, Barclaycard has a 24/7 contact number: +44 (0)1604 230 230, Barclay Banks 24/7 contact number: +44 1928 584421. Thats because the non-sterling transaction fee is often lower when using a debit card. Order foreign currency.

offer credit facilities from a panel of lenders. To get the most out of this option, you should keep all your receipts and check your card statements thoroughly. In the UK we process nearly 1 in every 3 spent using credit and debit cards, and in 2021 we processed over 270bn in transactions globally. [Return to reference]. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. Analysts who have reviewed the exchange rates applied over time have found that Mastercard tends to offer marginally better rates for international purchases. with a fee of 3 per month, your representative rate is 27.7% APR (variable). In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. If you lose your card when youre abroad, you must contact either Barclays Bank, or Barclaycard to report the loss. This will also tell you the end date for the promotion. In both cases, theyll cancel the card and may be able to issue you a temporary card or some emergency funds to tide you over while youre away. For further information, please emailcontact-MCI@barclays.com. How do I find my sort code and account number? In most circumstances, Visa converts transactions into sterling using the Visa Exchange Rate on the day the transaction is authorised. The reopening of live event venues also gave the entertainment sector a sizeable boost (up 41.1 per cent), spurred by demand for festival and theatre tickets and family days out. The two sterling amounts are then added together and divided by the original currency payment amount to work out the new exchange rate. Does Mastercard provide better rates than Visa? If a retailer has the contactless symbol displayed, then you should be able to use your contactless card just the same as you do at home. Unless we've said otherwise, products are in no particular order. To help you stay on top of your finances you can also get notifications on your wallet balance. As we explain in our customer terms, we calculate our exchange rate using the reference exchange rate for the Visa card scheme. Because of this, and the risk that your card is stolen or lost, its well worth having a secondary bank card just in case theres a problem with your main card. finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. It relates to the period 1 January 2022 to 25 November 2022. View a comparison of our current exchange rate for certain currencies as a mark-up against the rate published by the European Central Bank. For example, lets say, you have a Barclays Visa debit card. Despite rising inflation and higher food prices, spending on groceries was down -0.1 per cent overall compared to 2021. Convert and transfer unused travel money back into your account in a click, Lose the stress of carrying lots of cash with you In this case, the bank will apply the exchange rate being used by Visa on that day in order to convert your purchase into GBP. A minimum of 100,000 (or currency equivalent) 1, 2. Fly high and earn Avios while you spend with the Barclaycard Avios Plus Credit Card. Harry Wallop, Retail Expert and Commentator, said: 2022 has been a contrasting year for retail and consumer spending. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. The most popular methods to obtain greater value from grocery shopping this year were paying closer attention to the prices of specific items (55 per cent), cutting down on one-off treats (51 per cent), and switching to unbranded or supermarket-branded versions of popular items (51 per cent). Its also worth being wary, as some individual banks or ATM providers might levy their own fees on top of those your bank charges. Barclaycard, Barclays debit card and foreign transaction fees. *** The consumer confidence survey for this statistic was carried out between 24 and 28 June 2022 by Opinium Research on behalf of Barclaycard. If the Barclaycard you have (or are considering) isnt great for overseas use, you may opt to switch to an alternative credit card, or even take out a second credit card that you only use when youre out of the country. WebBuy foreign currency in your app and spend it on your debit card. This is the date on which the transaction took place (might be different to the day on which Visa processed the transaction). Simply spending abroad on your Barclays debit card, or withdrawing cash, normally incurs a foreign exchange fee of 2.75 per cent. [Return to reference], 2 Premier Charge Card and Woolwich Openplan cards dont have 56 days interest-free purchases. [2], 1 The 2.99% purchase fee might not apply if you have a Barclays Infinite, Barclaycard Platinum Travel, Barclaycard Platinum Cashback Plus or Barclaycard Rewards card, or if we've recently offered you a lower promotional fee by letter or email. A foreign provider, however, has no such obligation and, thus, has no problem happily marking up an exchange rate so they can pocket the difference. * The consumer confidence survey for this statistic was carried out between 15 and 18 December 2022 by Opinium Research on behalf of Barclaycard. Keep your documents safe, wherever you are. Registered office for all: 1 Churchill Place, London E14 5HP. Here are some cards with favourable overseas spending terms. However, the differences are fairly small and will vary depending on which currency youre spending in. A minimum of 100,000 (or currency equivalent) 1, 2. How much does a balance transfer card cost? This includes cash withdrawals in a foreign currency outside the UK, debit card payments in a foreign currency, refunds and shopping online on a non-UK website. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. Paying in sterling makes the price youre paying clearer, and means you dont have to pay the non-sterling purchase fee. Esme Harwood, Director at Barclaycard, said: The lifting of all Covid restrictions meant card spending was up overall compared to last year. Other cards may have different fees, which youll find in the summary box on your statement. The exchange rate used will fluctuate, of course, so its worth checking the online tools regularly.

This can be in savings and/or investments across all your accounts with us. However, some credit cards come with promotional offers which could mean that you have a grace period during which your purchases are interest-free. Not only does Wise use the real mid-market exchange rates to convert your money (which almost always beats the banks), but since your currency is received and sent via local banking systems in both your home country and in the UK., all those nasty international fees magically disappear. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. If you lose your card when youre abroad, you must contact either Barclays Bank, or Barclaycard to report the loss. Unsure what to search for? finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. As these inflationary pressures continue, all categories are likely to face further headwinds in 2023.

To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. Youll need to have a current account with us, be aged 16 or over and have a mobile number to use the Barclays app. Shoppers turned to insperiences at-home experiences as a way to cut back on non-essential spending during the cost-of-living crisis, with the category rising 4.1 per cent year-on-year. So, take these tips, and make sure you know before you go, which method of payment is going to be best for you. Cash Learn how we maintain accuracy on our site. Safer than cash. Other customers found these links helpful. This meant pharmacy, health & beauty retailers, as well as clothing and department stores saw noticeable growth compared to 2021 (14.7 per cent, 11.2 per cent and 7.4 per cent respectively), with consumers updating their looks and wardrobes by purchasing new make-up, clothes and accessories. A minimum of 100,000 (or currency equivalent) 1, 2.

Please note that travel wallet is currently only available to sole account holders. Its also worth remembering cash is still the main form of payment in some countries. Using a debit card is better if you intend to mainly pay using your card, rather than taking out cash from an ATM. Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries. Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority. Your full guide to using a US Discover card abroad. Log in to the app WebFees for using your card abroad. Digital content and subscriptions was one category within insperiences which saw a slight year-on-year decline (-0.8 per cent). Take the worry out of fluctuating exchange rates. Takeaways and fast food which has grown steadily since the first Covid-19 lockdown jumped another 12.3 per cent this year, as Brits continued to crave convenient meal options and even more restaurants moved online to satisfy that demand. Holidaymakers booked more getaways abroad, resulting in large increases for travel agents (190.6 per cent) and airlines (132.1 per cent), despite the disruption across the aviation sector during the summer months.