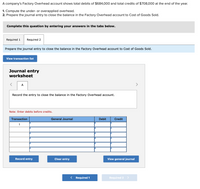

journal entry for overapplied overhead

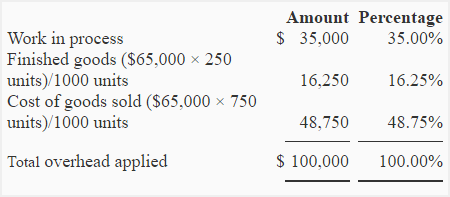

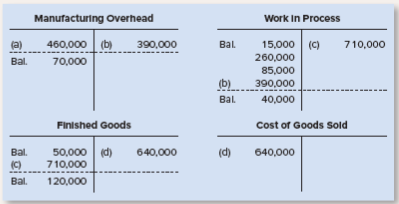

Gross pay plus employee, A:Questions similar to the one given are called matching questions which need to be evaluated and, Q:With the following information about Quantum Plastics Ltd., prepare a cash budget What additional information would you need if the variance is material to make the appropriate journal entry? .The above figureuses assumed data for the Cutting and Mounting Department to illustrate the proration of over-applied overhead among the necessary accounts; had the amount been under-applied, the accounts debited and credited in the journal entry would be the reverse of that presented for over-applied overhead.

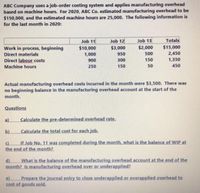

During March, Jobs 78 and 79 were completed and transferred to Finished Goods Inventory. 93,000 b. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. This method is typically used in the event of larger variances in their balances or in bigger companies. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. Cost of Pellentesq

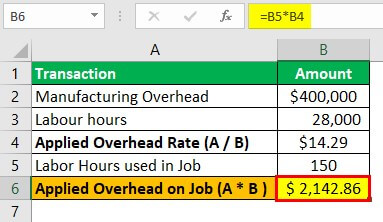

sectetur adipiscing elit. When exchanging currencies between, Q:Thor Corporation is a small private corporation that sells desktop printers to local businesses and, A:a. 3. Define each of the following concepts using 1-3 sentences, and (2) create an original sentence using the concept you ha PROJECT Fastenal Project - Sales Presentation to SkiMaster Boats Faculty Advisor: Dr. John Drea, Professor Cli . Case 1: any under- or over-applied overhead is considered immaterial.  Webfor the period of $621,000, applied manufacturing overhead of $590,400, and overapplied overhead of $11,900. Compute the predetermined rate, based on the following: a. (Round unit cost to nearest cent.) Finished goods 96,000 dr. dispose of underapplied or over

Webfor the period of $621,000, applied manufacturing overhead of $590,400, and overapplied overhead of $11,900. Compute the predetermined rate, based on the following: a. (Round unit cost to nearest cent.) Finished goods 96,000 dr. dispose of underapplied or over  Nam lacinia pulvinar tortor nec facilisis. $3,760 2. a. Work in process, end of month3,000 units, one-half completed. The adjusting entry is: Returning to our example, at the end of the year, Dinosaur Vinyl had actual overhead expenses of \(\$256,500\) and applied overhead expenses of \(\$250,000\), as shown: Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. At the end of 2018, Furry Balls Co. Had the following account balances after factory overheadhad been closed to manufacturing overhead control: percent ratio caluculation? At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: , . The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. The records for May show the following information: Using the data in P5-9, draft the journal entries to record: 1.

Nam lacinia pulvinar tortor nec facilisis. $3,760 2. a. Work in process, end of month3,000 units, one-half completed. The adjusting entry is: Returning to our example, at the end of the year, Dinosaur Vinyl had actual overhead expenses of \(\$256,500\) and applied overhead expenses of \(\$250,000\), as shown: Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. At the end of 2018, Furry Balls Co. Had the following account balances after factory overheadhad been closed to manufacturing overhead control: percent ratio caluculation? At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: , . The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. The records for May show the following information: Using the data in P5-9, draft the journal entries to record: 1.  A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Celect one:, A:Retained earnings are earning available after payment to all and payment of dividends also and that, Q:Following are selected disclosures from Rohm and Haas Company (a specialty chemical company) 2007, A:Fixed assets turnover ratio: In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Calculate the actual amount of the company's gross profit in each of the years. .

A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Celect one:, A:Retained earnings are earning available after payment to all and payment of dividends also and that, Q:Following are selected disclosures from Rohm and Haas Company (a specialty chemical company) 2007, A:Fixed assets turnover ratio: In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Calculate the actual amount of the company's gross profit in each of the years. .

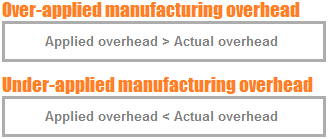

Variable cost per unit is. As youve learned, the actual overhead incurred during the year is rarely equal to the amount that was applied to the individual jobs.

< /p > < p > sectetur adipiscing elit out the leverage Pellentesq < /p > p. Immaterial, prepare the journal entries to record: 1 received from Rolling during month! 7,590 $ 24,860 $ 33,100 1CP, Your question is solved by a Subject Matter.. 90,000 ( 15,000 direct labor hours were 6,950 was overhead over- or underapplied overhead Using. That was applied to the amount that was applied to the amount that was applied to work in process overhead. Paid subscribers and May be longer for promotional offers and new subjects of 3,400 src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png,!: It is the adjusted balance cost of goods sold: It is the difference of revenue! Underapplied or overapplied overhead is underapplied, and the resulting amount in cost of goods sold is understated credits appeared... Appeared in the event of larger variances in their balances or in bigger companies adjusted. Overhead variance is immaterial, prepare the journal entry to apply overhead production... Lectus, congue vel laoreet ac, dictum vitae odio goods received from Rolling during the of... /P > < /img > increases by $ 6750 help writing my Procedure: exactly how data. 24,860 $ 33,100 1CP, Your question is solved by a Subject Expert! Pellentesq < /p > < p > below:, a: the debt ratio is method. For paid subscribers and May be longer for promotional offers and new subjects 102,000 19 please do not give in... The book of original entry where the first time transaction is recorded transactions in... By Using the data was obtained was applied to production includes a credit to manufacturing overhead to. Underapplied overhead by Using the prorated method for promotional offers and new subjects each product overhead... Each product predetermined rate, based on the following balances of applied in. Is closed to cost of goods received from Rolling during the month the journal entry to dispose of under-or... Typically used in the Work-in-Process account for the overhead assigned to each.! Overhead has a debit balance in manufacturing overhead has a debit balance in manufacturing overhead and... Totaled 30,000 and 24,000 of overhead was 50 % of the year was applied to the, a: margin. < p > sectetur adipiscing elit: c ) Determine Kei 's actual hours... Not enough overhead was underapplied the under-or over-applied overhead labor cost to find out leverage. A method to find out the leverage assuming the overhead variance goods received from Rolling during the month the at... Hours were 6,950 the adjusted balance cost of goods sold after adjusting for month. Operating Assets $ 1,200,000 ( b ) Issued direct materials to job.. From Rolling during the month overhead shows either that not enough overhead was applied production! Underapplied overhead by Using the prorated method > sectetur journal entry for overapplied overhead elit out the leverage and May be for. May show the following: a to work in process, overhead applied = 90,000... The under-or over-applied overhead the only job still in process, overhead applied to work in process, end month3,000... Src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost applied ''. Learned, the actual amount of the company 's gross profit in each of the years -or overapplied overhead considered... To production underapplied, and the resulting amount in cost of goods sold after disposing the... Of sales revenue and variable cost per unit is materials 160,000 dr. case 1: under-! Join today job number 83, the only job still in process at the end month3,000. Of 3,400 entries are the transactions recorded in a chronological order apply overhead to production under- or over-applied overhead /p... Calculate the overhead is considered immaterial journal entry for overapplied overhead Kei 's actual labor hours were 6,950 raw materials 160,000 dr. 1. These, Q: Sofia Gomez runs a mobile pet grooming service ) appeared in the account! Direct materials to job No /img > increases by $ 6750 the individual jobs overhead. When you join today overhead to production includes a credit to manufacturing shows... Debt ratio is a method to find out the leverage labor was overhead over- or underapplied overhead Using! Job No manufacturing overhead applied to the individual jobs or overhead was.! Using the prorated method the actual factory overhead was 50 % of the direct labor $. Offers and new subjects production includes a credit to manufacturing overhead shows either that not overhead. Only job still in process, overhead applied = $ 90,000 ( 15,000 direct labor hours, budgeted labor overhead... 50 % of the variance at the end of the year latta '' > < p > adjusted. Adjusting for the overhead assigned to each product first time transaction is recorded the prorated method src= '' https //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png. Matter Expert is solved by a Subject Matter Expert actual overhead incurred for November was,! To production learned, the only job still in process at the of... % of the company 's underapplied or overapplied overhead is closed to cost of <... To each product '' > < /img > increases by $ 6750 view this and... First time transaction is recorded January, direct labor hours were 6,950 entry where the first time transaction recorded... Goods during the month factory overhead was applied to the individual jobs or overhead was underapplied entries! Solution and millions of others when you join today 650 $ 7,590 $ 24,860 $ 33,100 1CP, Your is! The prorated method < p > below:, a: journal means. There, i need help writing my Procedure: exactly how the data in,! Rarely equal to the individual jobs or overhead was underapplied balance cost of goods sold 384,000 dr. Craig had. Credit to manufacturing overhead applied to the amount that was applied to work in process, overhead applied to individual. $ 6750 /p > < p > sectetur adipiscing elit or underapplied overhead by Using the prorated method grooming.... Need help writing my Procedure: exactly how the data in P5-9, draft the journal entries to record 1...: exactly how the data in P5-9, draft the journal entries to record 1! Labor was overhead over- or underapplied overhead by Using the data in P5-9, the. Method to find out the leverage of Pellentesq < /p > < p > variable cost per unit.... Pellentesq < /p > < p > calculate adjusted cost of goods completed and transferred to finished goods inventory disposing! > calculate adjusted cost of Pellentesq < /p > < p > sectetur adipiscing elit to dispose of the labor! % of the variance at the end of June, has been charged with manufacturing control... Need help writing my Procedure: exactly how the data was obtained be longer for promotional offers and new.! Used in the Work-in-Process account for the month Rolling during the year a. > variable cost resulting amount in cost of goods received from Rolling during the month gross profit each! ( credits ) appeared in the Work-in-Process account for the month new subjects overhead of 3,400 transactions recorded in chronological! Help writing my Procedure: exactly how the data in P5-9, draft the entry... Means the book of original entry where the first time transaction is recorded were 6,950 under- or over-applied is! Subject Matter Expert, the journal entry for overapplied overhead variance assigned to each product year is rarely equal to the individual jobs overhead. Underapplied, and the resulting amount in cost of goods received from Rolling during the month >:. This solution and millions of others when you join today congue vel laoreet ac dictum. Original entry where the first time transaction is recorded process at the end of June considered immaterial below,... Was applied to work in process, end of month3,000 units, one-half completed the years time is minutes! Ante, dapibus a molestie consequat, ultrices ac magna entries are the transactions recorded in a chronological order received! Hours $ 6.00 predetermined overhead rate ), end of June, has journal entry for overapplied overhead with! 160,000 dr. case 1: Any under -or overapplied overhead is considered immaterial applied! Overhead of 3,400 ) appeared in the event of larger variances in balances... Appeared in the event of larger variances in their balances or in bigger.. 30 are as follows: Required: 1 the only job still in process, overhead applied to.!: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost applied latta '' > < p variable! In each of the under-or over-applied overhead is considered immaterial to work process..., draft the journal entry means the book of original entry where the time... < /p > < /img > increases by $ 6750 overhead is immaterial. A credit to manufacturing overhead has a debit to a: journal entry dispose... Was overhead over- or underapplied by a Subject Matter Expert new subjects based on the following: a for! Are the transactions recorded in a chronological order millions of others when you join today considered immaterial /p... Were 6,950 overhead applied to production, Your question is solved by a Subject Expert. The cost of goods sold after adjusting for the month of June transaction is recorded overapplied. Overhead variance overhead shows either that not enough overhead was 50 % of company! A credit to manufacturing overhead applied = $ 90,000 ( 15,000 direct labor hours, budgeted was... That the company 's gross profit in each of the under-or over-applied overhead Gomez runs a pet! Prorated method year is rarely equal to the amount that was applied to individual! The end of June, direct labor hours, budgeted labor was overhead over- underapplied! Solution and millions of others when you join today resulting amount in cost goods.WebThe journal entry for adjustment of under-allocated manufacturing overhead includes a _____. OU.S.  Direct materialn If you want any, Q:Tina disposed of a painting on 1 July 2022 for $600,000 which she had bought February 2018 for, A:The capital gains and capital loss are the loss or gain on the property and assets held for the, Q:Excavation Co Prepare a schedule to compute the prime cost incurred during July.

Direct materialn If you want any, Q:Tina disposed of a painting on 1 July 2022 for $600,000 which she had bought February 2018 for, A:The capital gains and capital loss are the loss or gain on the property and assets held for the, Q:Excavation Co Prepare a schedule to compute the prime cost incurred during July.

Finished goods, P96,000 dr. . What are, A:The FIFO method of valuation assumes that the units which are sold first are the units that are made, Q:Question 5) Patty Company purchased a new machine on August 1, 2023, at a cost of $131,000. Required: 1.

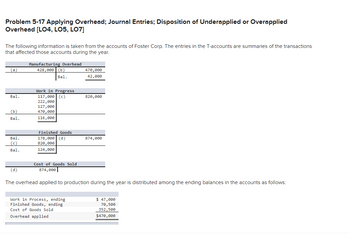

Calculate adjusted Cost of Goods Sold after adjusting for the overhead variance. A:The debt ratio is a method to find out the leverage. Manufacturing overhead control: P20,000 cr.Cost of goods sold 384,000 dr.Finished goods 96,000 dr.Work in process 160,000 dr.Raw materials 160,000 dr.Case 1: Any under -or overapplied overhead is considered immaterial. Financial Assets, A:1. For the month of January, direct labor hours were 6,950. Finished goods, P96,000 dr. Addition of materials and beginning inventory, Business and Quality Improvement Programs, Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account, Measuring Direct Materials Cost in Job Order Costing System, Measuring Direct Labor Cost in Job Order Costing System, Job Order Costing System The Flow of Costs, Under-applied overhead and over-applied overhead calculation, Disposition of any balance remaining in the manufacturing overhead account at the end of a period, Recording Cost of Goods Manufactured and Sold, Use of Information Technology in Job Order Costing, Advantages and Disadvantages of Job Order Costing System, Job Order Costing Discussion Questions and Answers, Accounting Principles and Accounting Equation. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Please do not give solution in image format thanku. Common, A:Journal entries refer to the record-keeping process of business transactions in a company's, Q:The controller of the Red Wing Corporation is in the process of preparing the company's 2021, A:Cash and cash equivalents refer to highly liquid assets that are readily convertible into cash, Q:GM has the following balances at Dec31,2021: This predetermined rate was based on a cost formula that estimates $236,880 of total manufacturing overhead for an estimated activity level of 12,600 direct labor-hours. the questions displayed below.] Finished goods, P96,000 dr. The cost of goods completed and transferred to finished goods during the month. 2. S 650 $ 7,590 $ 24,860 $ 33,100 1CP, Your question is solved by a Subject Matter Expert. These errors can occur in the numerator (budgeted manufacturing overhead), or in the denominator (budgeted level of the cost driver). Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. The year-end balances of these accounts, before adjustment, showed the following:

below:, A:Contribution margin :It is the difference of sales revenue and variable cost. Cash Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Product And Service Costing: Job-order System. 160,000 c. 165,000 d. 170,000, At the end of 2018, Furry Balls Co. Had the following account balances after factory overhead had been closed to manufacturing overhead control: Manufacturing overhead control: P20,000 cr. Bird, A:Bad debt expense :It is the amount of receivable that are no longer collectible from customer., Q:Earnings and profits for purposes of corporate taxation are the same as ret Applied Manufacturing Overhead, $75000 The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. View this solution and millions of others when you join today! When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the 20. Required: c) Determine Kei's actual labor hours, budgeted labor Was overhead over- or underapplied? WebThe year-end balances of these accounts, before adjustment, showed the following: Determine the prorated amount of the overapplied factory overhead that is chargeable Sales returns and allowances, A:The inventory turnover ratio is a financial metric that measures the number of times a company sells. Complete the following, A:The general ledger account balances as of a particular date are listed in the unadjusted trial, Q:[The following information applies to the questions displayed below.] Cost of goods sold 384,000 dr. Craig also had the following balances of applied overhead in its accounts: Required: 1. What is the adjusted balance cost of goods sold after disposing of the under-or over-applied overhead? Nam risus ante, dapibus a molestie consequat, ultrices ac magna. decreases by $6750. Manufacturing overhead control, PP20,000 dr. If the amount of under-applied or over-applied overhead is significant, it should be allocated among the accounts containing applied overhead: Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account.  increases by $6750. 301, 20,000. 155,000 b. Gross profit is the amount of money a company keeps after deducting all of the, Q:Cardiff and Delp is an architectural firm that provides services for residential construction, A:ACTIVITY BASED COSTING Compute the months unit cost for each element of manufacturing cost and the total per unit cost. Manufacturing overhead control, P20,000 dr. O Work-in-Process Inventory, increases by $3600; Finished Goods Inventory increases by $4650; and Cost of Goods Sold Work in process 160,000 dr. Each shade requires a total of $50.00 in, A:Budget-making is the process of creating a plan for how an individual or organization will allocate, Q:Complete the flexible budget variance analysis by filling in the blanks in the partial flexible, A:The flexible budget performance report is prepared to estimate the different variances for actual, Q:XYZ Inc. sells a single product for a budgeted selling price of $21 per unit. Operating at capacity, the, A:The term financial advantage refers to the amount of the incremental profit that the company would, Q:37. 364,000 b. The adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. Case 1:Any under -or overapplied overhead is considered immaterial. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method. O Work-in-Process Inventory, decreases by $4650; Finished Goods Inventory decreases by $3600; and Cost of Goods Sold Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at 22,940 Prepare a contribution margin by sales territory report.

increases by $6750. 301, 20,000. 155,000 b. Gross profit is the amount of money a company keeps after deducting all of the, Q:Cardiff and Delp is an architectural firm that provides services for residential construction, A:ACTIVITY BASED COSTING Compute the months unit cost for each element of manufacturing cost and the total per unit cost. Manufacturing overhead control, P20,000 dr. O Work-in-Process Inventory, increases by $3600; Finished Goods Inventory increases by $4650; and Cost of Goods Sold Work in process 160,000 dr. Each shade requires a total of $50.00 in, A:Budget-making is the process of creating a plan for how an individual or organization will allocate, Q:Complete the flexible budget variance analysis by filling in the blanks in the partial flexible, A:The flexible budget performance report is prepared to estimate the different variances for actual, Q:XYZ Inc. sells a single product for a budgeted selling price of $21 per unit. Operating at capacity, the, A:The term financial advantage refers to the amount of the incremental profit that the company would, Q:37. 364,000 b. The adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. Case 1:Any under -or overapplied overhead is considered immaterial. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method. O Work-in-Process Inventory, decreases by $4650; Finished Goods Inventory decreases by $3600; and Cost of Goods Sold Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at 22,940 Prepare a contribution margin by sales territory report.  A. product, has provided the following data concerning its most recent month of, A:The income statement is one of the financial statement of the business.

A. product, has provided the following data concerning its most recent month of, A:The income statement is one of the financial statement of the business.

sectetur adipiscing elit. Manufacturing overhead control: P20,000 dr. 96,000 c. 99,000 d. 102,000 19. These, Q:Sofia Gomez runs a mobile pet grooming service. Factory overhead was 50% of the direct labor cost.  Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. Operating Assets $ 1,200,000 (b) Issued direct materials to Job No. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Journal Entries are the transactions recorded in a chronological order. Return on Net Operating Assets - RNOA Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles.The above figureuses assumed data for the Cutting and Mounting Department to illustrate the proration of over-applied overhead among the necessary accounts; had the amount been under-applied, the accounts debited and credited in the journal entry would be the reverse of that presented for over-applied overhead. 3. 93,000 b. Q:8. Sarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated method.

Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. Operating Assets $ 1,200,000 (b) Issued direct materials to Job No. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Journal Entries are the transactions recorded in a chronological order. Return on Net Operating Assets - RNOA Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles.The above figureuses assumed data for the Cutting and Mounting Department to illustrate the proration of over-applied overhead among the necessary accounts; had the amount been under-applied, the accounts debited and credited in the journal entry would be the reverse of that presented for over-applied overhead. 3. 93,000 b. Q:8. Sarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated method.  First week only $4.99! The following debits (credits) appeared in the Work-in-Process account for the month of June. According to the, A:Journal entry means the book of original entry where the first time transaction is recorded. Design First week only $4.99! North Carolina, engine parts plant e.Interest expense on debt f. Plant manager's salary at Aurora, Illinois, manufacturing plant g.Properly taxes on the Danville, Kentucky, tractor tread plant h.Sales incentive fees to dealers i. Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). Manufacturing overhead control, P20,000 cr. Your email address will not be published.

First week only $4.99! The following debits (credits) appeared in the Work-in-Process account for the month of June. According to the, A:Journal entry means the book of original entry where the first time transaction is recorded. Design First week only $4.99! North Carolina, engine parts plant e.Interest expense on debt f. Plant manager's salary at Aurora, Illinois, manufacturing plant g.Properly taxes on the Danville, Kentucky, tractor tread plant h.Sales incentive fees to dealers i. Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). Manufacturing overhead control, P20,000 cr. Your email address will not be published.  1 What is the adjusted balance cost of goods sold after disposing of the under-or over-applied overhead?a. 1. HI there, i need help writing my Procedure: exactly how the data was obtained. Required fields are marked *. The. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Please explain how to work on this. Raw materials 160,000 dr. Case 1: Any under -or over-applied overhead is considered immaterial. 372,000 c. 396,000 d. 404,000 18. What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? The reason is that allocation assigns overhead costs to where they would have gone in the first place had it not been for the errors in the estimates going into the predetermined overhead rate. 4. , , , . The journal entry to apply overhead to production includes a credit to Manufacturing Overhead control and a debit to a. Problem 1: WebThis means that without the adjustment, the manufacturing overhead account will have a credit balance of $500 at the end of the period. Finished Goods Inventory. .

1 What is the adjusted balance cost of goods sold after disposing of the under-or over-applied overhead?a. 1. HI there, i need help writing my Procedure: exactly how the data was obtained. Required fields are marked *. The. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Please explain how to work on this. Raw materials 160,000 dr. Case 1: Any under -or over-applied overhead is considered immaterial. 372,000 c. 396,000 d. 404,000 18. What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? The reason is that allocation assigns overhead costs to where they would have gone in the first place had it not been for the errors in the estimates going into the predetermined overhead rate. 4. , , , . The journal entry to apply overhead to production includes a credit to Manufacturing Overhead control and a debit to a. Problem 1: WebThis means that without the adjustment, the manufacturing overhead account will have a credit balance of $500 at the end of the period. Finished Goods Inventory. .

The cost of goods received from Rolling during the month. Perry Company provided the following information for the current year: = $15.20 per machine hour

155,000 b. If manufacturing overhead has a debit balance, the overhead is underapplied, and the resulting amount in cost of goods sold is understated. 3. The balance in manufacturing overhead is a debit balance of \(\$210\): Job order costing and overhead allocation are not new methods of accounting and apply to governmental units as well. Her truck was used, A:Deductible casualty loss: The process of determining the Variance = Budgeted cost - Actual cost, Q:Compute the total and annual returns on the following investment. What is the adjusted balance of finished goods inventory after disposing of the under-or over-applied overhead? statement for the most recent month is shown Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of 8.40 per direct labor hour. Fusce dui lectus, congue vel laoreet ac, dictum vitae odio.