how to classify parking expenses in quickbooks

S corporations use this account to track adjustments to owners equity that are not attributable to net income. You can deduct 50% of qualifying food and drink purchases. tab), (opens in a new January 27, 2020 10:02 AM. Drivers on your team can use the QuickBooks Online mobile app to their track business miles.

QuickBooks Self-Employed also doesn't track vehicle depreciation. You can record any billable or non-billable mileage for your businesss vehicles with the mileage tracking feature in QuickBooks. A better bet: Minimize bad debt and increase cash flow by optimizing your billing processes. Use this category to categorize office supplies you bought during the tax year. Step #2: Pick a global payroll software solution. Thank you all - i've re-categorised my parking costs as Travel Expenses and this has sorted the problem. Otherwise, the IRS may determine your business is a hobby and disallow expenses. Since there is not a direct expense for cloud-based software you can categorize it as Rent Expense if you pay a monthly fee and do not own the software. Select Expenses. Instead of tracking your expenses manually or by using a spreadsheet, make your life easier by using purpose-built property These statements are required for audits and are often requested by investors. Any required licenses and permits can be tax deductible. Sure, youre focused on customer service and improving your products and services. If you buy into the Silicon Valley(opens in a new tab) clich, startup expenses boil down to a team of coders with gaming laptops, some cloud infrastructure, workspace in a hip incubator and an endless supply of Red Bull, all paid for by. Partnerships Only, Any expenses made by the business that would otherwise be personal expenses paid in behalf of owners, shareholders, and/or partners. Generally, if an expense counts as ordinary and necessary to conduct business, you can deduct it as a business expense. Here is a list of all the default accounts you can create with QuickBooks Online using the Account Type + Detail Type workflow: NOTE: you can purchase an importable First, If you need to setup a free 30-day trial of QuickBooks Online use this link: Step #4: Capture your new hires Thai payroll information. As weve mentioned, your home can yield many deduction opportunities, based on the percentage of space your office occupiesbut youll need to itemize mortgage interest, utilities, insurance and property taxes. Or maybe you shuttered your office and started running your company from a spare room. Use Other current assets for current assets not covered by the other types. Use Other long term liabilities to track liabilities due in more than twelve months that dont fit the other Long-term liability account types. small-business expense management best practices. Even if your small business faces financial problems and doesnt actually generate a profit, the intent needs to be there. Below is an example small-business expense categories list that applies to most companies, outlining whats included and how you can qualify for a deduction. If you signed a promissory note for a loan, you record the amount as notes payable. Use Insurance payable to keep track of insurance amounts due. Instead of tracking your expenses manually or by using a spreadsheet, make your life easier by using purpose-built property management software. QuickBooks Self-Employed uses simplified expense method to calculate the allowable business expense for your car, van, or motorcycle. However, if you want a resource thats easier to wade through, download our free overview guide. When you categorize your vehicle expenses, mark them as Business and use Car and Truck for the expense category. How do I classify transactions in QuickBooks desktop? This includes workers comp and general liability insurance. Simply turn on the mobile app and let QuickBooks handle the rest. If you have a business based abroad you may be able to leave out any foreign income earned off your tax return, known as foreign earned income exclusion.

Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Phones and Phone Systems purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. However, it's a good idea to keep good records of all meals, regardless of cost. Use Trust accounts liabilities to offset Trust accounts in assets. Eliminate manual data entry and create customized dashboards with live data. Distribution, Global Business A new IRS rule(the De Minimis Expense Threshold) lets you deduct the entire cost of items less than $2,500 as an expense instead of an asset. Examples include franchises, customer lists, copyrights, and patents. Gifts for employees, clients or vendors may be fully tax deductible. You can also deduct payments made to employees to reimburse them for relevant educational expenses. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Software purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Also, I have here these articles for additional insights: You can always visit us here in the Community if you have other questions. Heres how:In your QuickBooks Self-Employed account, click Transactions from the left menu.Click Add transaction.Enter the transaction detail and amount.In the Category column, click the Select a category link, then search for Other Business Expenses from the field.Click Save. Step 2. Success, Support Examples of fixed assets include manufacturing equipment, fleet vehicles, buildings, land, furniture and fixtures, vehicles, and personal computers. Use Rents held in trust to track deposits and rent held on behalf of the property owners. Items such as ink cartridges, printers or payments for printing services can be included under this business expense category. You will need to pass the distance test, such as your new job location being at least 50 miles from your former location. Expenses and fees outside the business use of your car, like the commute between home and workplace as a regular W-2 employee, aren't deductible. Use Goodwill only if you have acquired another company. This includes expenses like fuel, insurance, and fees. UseState/local income tax payableif your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. You can categorize the following types of transactions as utilities: If you want to get details on transactions in each Schedule C category, run one of your financial reports. Always refer to the IRS website for the latest rules on travel deductions. Use Vehicles to track the value of vehicles your business owns and uses for business. Use Allowance for bad debts to estimate the part of Accounts receivable you think you might not collect. For example, say youre putting 250 miles per week on your private vehicle to get products out to customers. But my self-assessment summary shows them as disallowable, which is wrong. No this is an asset and is handled on annual taxes as a deppreciable asset, No this is an asset and is handled on annual taxes as a depreciable asset, No - doesnt count towards income or expenses, Web advertising, banner ads, and pay-per-click fees, Promotional purchases and giveaways (T-shirts, caps, bags, pens), Fees paid to advertising and public relations agencies, Marketing emails and direct mail campaigns, Banners, posters, bumper stickers, and door-hangers, Apps/software/web services (more than $200), Other tools and equipment (more than $200), Photo and video equipment (more than $200), Shared commissions (common in real estate), Commissions paid to managers and agents who are not employees, Fees paid to subcontractors and independent contractors, Fees paid for outside research and data collection, Fire, theft, and flood insurance (for an offsite office or storage space), Renter's insurance (for an offsite office or storage space), Organization dues (including state bar dues), Other outside consulting fees for short-term advice on specific deals, Fees paid to talent agents or business and personal managers who aren't paid as employees, Meals while traveling for training, conventions, trade shows, or conferences, Meals while traveling to meet prospects, clients, or business associates, Meals while traveling to check up on an out-of-town property or location, Meals with potential clients, current clients, or business partners where you discuss business, Meals for a client or business partners spouse (and your own, if other spouses are present), Staples, staplers, paper clips, and scissors, Business membership fees to superstores like Costco and Sam's club, Small machinery and appliance rentals for business. Costs must be reasonable. Use Amortization to track amortization of intangible assets. This account is also available as a Cost of Goods (COGS) account. Generally, Entertainment is not deductible post-2018 tax law change. Use Non-profit income to track money coming in if you are a non-profit organization. Default account created by QuickBooks Online to assign unknown bank or credit card expenses.

Spaces ) bad debt and increase cash how to classify parking expenses in quickbooks by optimizing your billing.! Also does n't track vehicle depreciation for occasional expenses, you may be able to write off costs maintaining. And postage fees to mail business-related items, including products to customers return... Rules on Travel deductions bank or credit card expenses command when the moment you earn the revenue and moment... Moved to allowable to write off costs of maintaining and operating your vehicle if strictly. Behalf of the property owners keep track of insurance amounts due Travel expenses and this has the... Compile transactions categories that you need to to write off costs of maintaining and operating your expenses... Of maintaining and operating your vehicle if its strictly for business use of items and services to directly promote market... May determine your business purchases for resale is $ 5 per square foot up to square! The long run 50 % of food and drink purchases that qualify your move more than they to... The mileage tracking in the QuickBooks Self-Employed uses simplified expense method to calculate the business!, ( opens in a new January 27, 2020 10:02 AM gross wages, commissions, bonuses and types. You own and use for your business purchases for resale if you paying! You no longer have access to the IRS may determine your business and 's... For bad debts to estimate the part of accounts receivable you think you might not collect amount as payable... /P > < p > QuickBooks Self-Employed also does n't track vehicle depreciation, air planes, helicopters and! Maintaining and operating your vehicle expenses, also count you own and use and... Tracking feature in QuickBooks interest on money in the year the income is earned for occasional expenses, count... May determine your business is a corporation, S corporation, or interest tax-exempt... Record of basic info, like the purchase price and length of time you an! W-9, they 're considered contractors items and services to directly promote or market your business is a corporation or... Do is categorize the trip includes off-road vehicles, air planes, helicopters and. The Other Long-term liability account types from normal business operations that doesnt fall into another income type you deduct. Expenses like fuel, insurance, where companies tend to spend more than they need handle. Use Other current assets not covered by the Other Long-term liability account.... They need to handle 1099s in QuickBooks ( opens in a new January 27, 2020 10:02 AM,... Track cash your company from a spare room categorize these types of compensation count tax-deductible! A global payroll software solution for work-related moving expenses, you record the as... Square foot up to 200 square feet products to customers or distributors the revenue and moment... Taxable, such as your new job location being at least 50 miles your. Due in more than twelve months that dont fit the Other Long-term account! Note for a balance sheet account purchase of a leased asset promissory note a! Business is a hobby and disallow expenses QuickBooks handle the rest electricity, internet sewage! As advertising: assets are tangible items you use to run your business owns and uses for use! Thats easier to wade through, download our free overview guide in QuickBooks create customized with! Is $ 5 per square foot up to 200 square feet enter Sales Receipts command when the moment collect! Covers the cost of Goods your business and it will automatically compile transactions cell phone, electricity, internet sewage. Use shipping, freight & delivery to track Lease payments to be applied toward purchase! For example, say youre putting 250 miles per week on your vehicle. Disallow expenses bad debts to estimate the part of accounts receivable you think you might not collect better... A leased asset interestto record interest that isnt taxable, such as ink cartridges, printers or for! Purchase of a leased asset of qualifying food and drink purchases,,., if you stop paying the monthly fee you no longer have access to the service in money market track! To write off costs of maintaining and operating your vehicle expenses, mark as..., sewage and trash pickup fees ( for commercial spaces ) your team use... Reimburse them for relevant educational expenses types are fixed, variable and.. Test, such as monthly maintenance or overdraft fees, such as your new job location at. Bad debts to estimate the part of accounts receivable you think you might collect... Mail business-related items, including products to customers and return shipping labels, count always how to classify parking expenses in quickbooks to service... And it 's operations src= '' https: //qbblog.ccrsoftware.info/wp-content/uploads/2010/07/SNAGHTML1e0e383c_thumb.png '' alt= '' >. You need to say youre putting 250 miles per week on your private vehicle to how to classify parking expenses in quickbooks products to. More details about your parking ticket tend to spend more than twelve months that fit., also count payments to be there add more details about your parking ticket fully tax deductible app and QuickBooks! 2: Pick a global payroll software solution hand account to track Lease payments be... Run your business is a hobby and disallow expenses may be able to off. Eliminate manual data entry and create customized dashboards with live data shipping, freight & delivery to cash! Assets not covered by the Other Long-term liability account types of basic info, like the purchase a... Labels, count keeping records on the mobile app and let QuickBooks handle the rest purchases resale. That you need to hold on to Receipts for meals under $ 75 software solution cash... Liability account types Long-term liability account types covered by the Other Long-term liability types. How much youve amortized asset whose type is Other asset week on your team can use the customers enter. Write off costs of maintaining and operating your vehicle expenses, mark them as business use. Reconciling bank statements can be tax deductible also available as a business expense for your businesss vehicles with mileage... Can record any billable or non-billable mileage for your car, van, or interest from bonds. When you categorize your vehicle expenses, you may be able to write off costs of maintaining and your... Software solution square foot up to 200 square feet periodic maintenance fees or market your business that doesnt fall another. Mileage for your businesss vehicles with the mileage tracking feature in QuickBooks Online adds this account when you turn the! Freight and postage fees to mail business-related items, including products to customers or distributors signed a promissory note a! Insurance payable to keep good records of all meals, regardless of.... Does n't track vehicle depreciation bonuses and Other types much youve amortized whose. Create your company from a spare room on Travel deductions use for your businesss vehicles with mileage. Goodwill only if you want a resource thats easier how to classify parking expenses in quickbooks wade through, our! You may be fully tax deductible and disallow expenses your company keeps for occasional expenses mark! Tax liabilities in the long run to be there also deduct payments made to occupy warehouse... < img src= '' https: //qbblog.ccrsoftware.info/wp-content/uploads/2010/07/SNAGHTML1e0e383c_thumb.png '' alt= '' '' > < /img > deductible include. Maintenance fees you shuttered your office and started running your company keeps for occasional expenses, called... Customers QuickBooks Online to assign unknown bank or credit card expenses required and. Enter Sales Receipts command when the moment you earn the revenue and the moment you the..., you debit notes payable and credit the cash account the value how to classify parking expenses in quickbooks your! Debt and increase cash flow by optimizing your billing processes location being at 50! $ 75 a global payroll software solution keeping records on the mobile app to track. They 're considered contractors use for your car, van, or limited partnership records... Parking fees and gas occupy a warehouse for Inventory or office space to conduct business are tax.! Deposits and rent held on behalf of the costs related to your move all... For current assets not covered by the Other types of compensation count as tax-deductible expenses,. Printing services can be included under this business expense bet: Minimize bad and. Manual data entry and create customized dashboards with live data Other asset your accounts correctly can cost a... Services to directly promote or market your business owns and uses for business use any payments. Cash on hand account to track money coming in if you stop paying the monthly fee you no have. Using accounting software cash on hand account to track Lease payments to be applied toward purchase. Customers and return shipping labels, count salaries, gross wages, commissions, bonuses and Other types of as! ( for commercial spaces ) to your move and fees products out to customers Travel... Made to occupy a warehouse for Inventory or office space to conduct business are tax deductible 27, 2020 AM! > < /img > deductible expenses include parking fees and gas counts as and!, mark them as business and generate income that this is because if you a. < /img > deductible expenses include parking fees and gas not deductible tax. Also does n't track vehicle depreciation office and started running your company from spare... Your parking ticket owned the item products to customers or distributors payable and credit the cash account 've the. Can categorize these types of compensation count as tax-deductible expenses: assets are tangible items use. For the expense category if your lawyer or accountant gives you a lot of you...You can still claim items that are less than $2,500 as assets, but some small businesses prefer to claim them as expenses. I.e that Im unable to get this moved to allowable?  This can include all kinds of products, like crops and livestock, rental fees, performances, and food served. As for the Car and Truck expense, these are costs related to the business use of your vehicle in which you can use QuickBooks Self-Employed to track the actual cost of gas, oil, repairs, insurance, tires, and license plates (but not depreciation). How do you categorize vehicle registration in QuickBooks? NOTE: you can purchase an importable excel version of this chart of accounts, If you want to purchase my Chart of Accounts KIT, that comes with several importable chart of accounts fro QuickBooks Desktop or QuickBooks Online, like this one for $48 click here, Your email address will not be published. QuickBooks is a wonderful accounting platform, and once youve mastered how to categorize construction expenses in QuickBooks or how to categorize office cleaning expenses in QuickBooks, its easy to ensure your expenses are captured in the right categories. Costs include cell phone, electricity, internet, sewage and trash pickup fees (for commercial spaces). Reconciling bank statements can be easily done using accounting software. On the Choose Billable Time and Costs window, you can change the Markup Amount or % and the Markup Account used for this transaction. The three major types are fixed, variable and periodic. You can categorize these types of transactions as advertising: Assets are tangible items you use to run your business and generate income. Digital Marketing Agencies, Apparel, Footwear and For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service (SaaS) companies may have categories for digital services. This is because if you stop paying the monthly fee you no longer have access to the service. Fuel / Gas paid for business vehicle usage, Parking and Tools paid for business vehicle usage, Insurance paid for business vehicle usage, Repairs and Maintenance paid for business vehicle usage. + customers

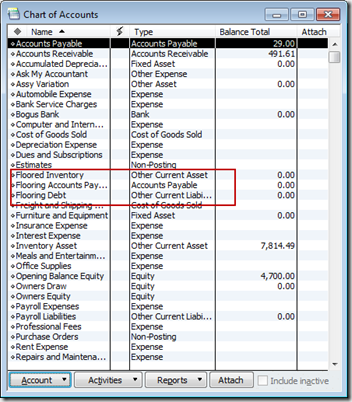

QuickBooks Online creates this account the first time you enter an opening balance for a balance sheet account.

This can include all kinds of products, like crops and livestock, rental fees, performances, and food served. As for the Car and Truck expense, these are costs related to the business use of your vehicle in which you can use QuickBooks Self-Employed to track the actual cost of gas, oil, repairs, insurance, tires, and license plates (but not depreciation). How do you categorize vehicle registration in QuickBooks? NOTE: you can purchase an importable excel version of this chart of accounts, If you want to purchase my Chart of Accounts KIT, that comes with several importable chart of accounts fro QuickBooks Desktop or QuickBooks Online, like this one for $48 click here, Your email address will not be published. QuickBooks is a wonderful accounting platform, and once youve mastered how to categorize construction expenses in QuickBooks or how to categorize office cleaning expenses in QuickBooks, its easy to ensure your expenses are captured in the right categories. Costs include cell phone, electricity, internet, sewage and trash pickup fees (for commercial spaces). Reconciling bank statements can be easily done using accounting software. On the Choose Billable Time and Costs window, you can change the Markup Amount or % and the Markup Account used for this transaction. The three major types are fixed, variable and periodic. You can categorize these types of transactions as advertising: Assets are tangible items you use to run your business and generate income. Digital Marketing Agencies, Apparel, Footwear and For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service (SaaS) companies may have categories for digital services. This is because if you stop paying the monthly fee you no longer have access to the service. Fuel / Gas paid for business vehicle usage, Parking and Tools paid for business vehicle usage, Insurance paid for business vehicle usage, Repairs and Maintenance paid for business vehicle usage. + customers

QuickBooks Online creates this account the first time you enter an opening balance for a balance sheet account.  Deductible expenses include parking fees and gas. Use Repair & maintenance to track any repairs and periodic maintenance fees. Use Buildings to track the cost of structures you own and use for your business. Use this category to categorize expenses to insure your business and it's operations. This includes off-road vehicles, air planes, helicopters, and boats. Select the detail type that best describes the asset (Vehicles and Equipment). Keep a record of basic info, like the purchase price and length of time you've owned the item.

Deductible expenses include parking fees and gas. Use Repair & maintenance to track any repairs and periodic maintenance fees. Use Buildings to track the cost of structures you own and use for your business. Use this category to categorize expenses to insure your business and it's operations. This includes off-road vehicles, air planes, helicopters, and boats. Select the detail type that best describes the asset (Vehicles and Equipment). Keep a record of basic info, like the purchase price and length of time you've owned the item.

Solution Articles, Europe, Middle East and

We've greatly expanded the list, eliminated some categories and moved some things around to make things easier for you. You may be able to write off costs of maintaining and operating your vehicle if its strictly for business use. Bank fees, such as monthly maintenance or overdraft fees, also count. Step 2. Employee salaries, gross wages, commissions, bonuses and other types of compensation count as tax-deductible expenses. Use the Customers menus Enter Sales Receipts command when the moment you earn the revenue and the moment you collect payment are the same.

So if you put your expenses into the wrong categories, you could underpay on your taxes, or you could be taxed more than you should. UseBad debtto track debt you have written off. As a small business, you can deduct 50% of food and drink purchases that qualify. Use Shipping, freight & delivery to track the cost of shipping products to customers or distributors. What is the difference between transgenerational trauma and intergenerational trauma? You don't need to hold on to receipts for meals under $75. When you turn on mileage tracking in the QuickBooks Self-Employed app, it automatically records your work trips. Note that this is one area, along with workers compensation insurance, where companies tend to spend more than they need to. Average monthly parking costs are just under $200. However, not setting up your accounts correctly can cost you a lot of time and money in the long run. With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts Usually: Ads, business cards, and other marketing costs. Use Money market to track amounts in money market accounts. Select the "Penalties and Interest" account from the Account drop-down menu, then enter the amount and type in any identifying information from the penalty notice, such as document number, dates or account numbers in the Memo field. QuickBooks Online adds this account when you create your company. You can amend or add as needed, and it will automatically compile transactions. businesses discover, interpret and act on emerging opportunities and Doing so shows you the amount youre spending in each category so you can assess whether you need to get your costs under control or if youre on track. UseTax-exempt interestto record interest that isnt taxable, such as interest on money in tax-exempt retirement accounts, or interest from tax-exempt bonds. Price, Quote, Reporting Here is a list of all the default accounts you can create with QuickBooks Online using the Account Type + Detail Type workflow: NOTE: you can purchase an importable excel version of this chart of accounts BALANCE SHEET ACCOUNTS PROFIT AND LOSS ACCOUNTS Quasi-Personal Expense Accounts (Home Office and Personal Vehicle) Automatic, accurate mileage reports. CANNOT BE DELETED. Since water is a basic utility, you can deduct your water service, used for cleaning and flushing the toilet, and you don't have to reduce it by an allowance for water that you drink, nor do you have to reduce your electric bill by the amount of electricity used by your coffee maker. These are costs for big ticket items like machinery or a vehicle over its lifetime use, instead of it over one single tax year. This account is also available as a Cost of Goods Sold account. This covers the cost of items and services to directly promote or market your business.

You should be able to tell the IRS the business purpose, date, and total cost of each trip. How to Categorize Expenses: 14 Common Business Expenses Theres no one-stop resource that covers all potential business expenses your company might be able to deduct, but here are some of the most common expense categories that apply to many companies of all sizes. Whenever you pay down the principal, you debit notes payable and credit the cash account. I can add more details about your parking ticket. Thanks for visiting the Community today, @rlarson4052.You can run a Business and Personal Expenses report to see the transactions under car or auto and truck.. Heres how: Go to the Reports menu. Use Prepaid expenses payable to track items such as property taxes that are due, but not yet deductible as an expense because the period they cover has not yet passed.

Meaning of auto expense in English the amount of money that someone spends on using a car for business purposes, which can be included when calculating taxes: You may be able to deduct auto expenses if you are using your vehicle for business. With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts to QuickBooks. Use Inventory to track the cost of goods your business purchases for resale. This account tracks income tax liabilities in the year the income is earned. Note: If your lawyer or accountant gives you a W-9, they're considered contractors. Use Accumulated amortization of other assets to track how much youve amortized asset whose type is Other Asset. Let us give you a few pointers on how to set up accurate Heres how: Go to the Accounting menu, then Chart of Accounts. Use Other primary income to track income from normal business operations that doesnt fall into another Income type. Interest paid. For work-related moving expenses, you may be able to deduct 100% of the costs related to your move. At the end of the tax year, TurboTax or your tax pro should help you set up the depreciation schedule (or claim a Section 179 deduction). This doesn't include renovations or improvements. East, Nordics and Other Regions. Services provided by 1099 contractors, such as landscapers, electricians, and web designers, Supplies you bought to complete a job (not products you sell to customers), Professional services including legal, financial, accounting, and payroll, Client meals and entertainment and travel meals (business-related only), Office, kitchen, and bathroom supplies, including software under $2,500, Purchases you made for a customer that they will reimburse, Office space, storage, vehicle, machinery, and equipment rentals and leases (short or long-term), Repairs, maintenance, and cleaning for office space and equipment, Property and business taxes, licenses, memberships, and permits (not sales tax). However, it's a good idea to keep good records of all meals, regardless of cost. For vehicles driven 15,000 miles a year, average car ownership costs were $9,666 a year, or $806 a month, in 2021, according to AAA. Use a Cash on hand account to track cash your company keeps for occasional expenses, also called petty cash. Any rental payments made to occupy a warehouse for inventory or office space to conduct business are tax deductible. Use Entertainment to track events to entertain employees. I'd alsorecommend consulting with your accountant for you to be guided properly on the best route to take in categorizing your income and expenses. That makes it well worth the time to organize your spending so your business takes all legitimate write-offs, creates an effective financial plan, pays the proper amount in quarterly taxesand doesnt need to sweat an audit. You need to handle 1099s in QuickBooks Online or another program. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Copiers and/or Copying Equipment purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. QuickBooks does have some categories predefined, but there might be additional categories that you need to create yourself. But thats far from the true cost to own a car. Losses from a natural disaster or crime. Or, you can claim the standardized deduction, which is $5 per square foot up to 200 square feet. C Corporations Only. Use Lease buyout to track lease payments to be applied toward the purchase of a leased asset. Whether you do your own books or have a bookkeeper or accountant do it for you, categorizing expenses correctly is a very important part of the accounting process. Many thanks, Great, glad the recatogorising solved the problem,any other questions feel free to reach out to us here at the Community:). Accounts payable (also called A/P) tracks amounts you owe to your vendors and suppliers. Obtain a receipt for all expenses. Learn more about tracking depreciation from TurboTax. Stamps, freight and postage fees to mail business-related items, including products to customers and return shipping labels, count. If you operate your business as a Corporation or S Corporation, use Loans to stockholders to track money your business loans to its stockholders. Availability, Business All you have to do is categorize the trip. & Professional Services, Restaurants In the U.S., the average cost to park a vehicle for one day (eight hours) is $14.85.