how is the homestead exemption calculated in ohio

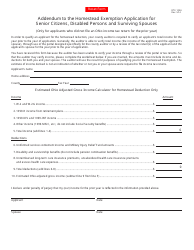

50 69%: %10,000 from the property value. A similar bill was also introduced last session, but it didn't advance much due to other issues like COVID-19 beingprioritized, he said. However, the formula for calculating the amount of your property taxes after the homestead exemption is factored in is fairly straightforward no matter where you live. The exemption takes the form of a credit on property tax bills. The The exact amount of savings Depending on state law, the exemption can depend not only on the propertys assessed value, but on the age of the homeowners. Accessed April 17, 2020. All rights reserved. 70 100%: $12,000 from the property value. U.S. House of Representatives, Office of the Law Revision Counsel. If we are unable to verify your income with this method, we will request that you provide a copy of the Ohio IT1040 and Ohio Schedule A for the appropriate year(s). Wheeland holds an Associate of Arts in accounting and criminal justice. Columbus, Ohio 43215

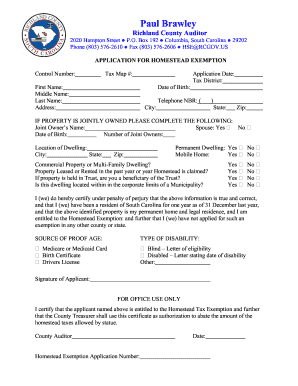

Webhomeowner. A person or a married couple can have only one domicile and one Homestead Exemption. Titus Wu is a reporter for the USA TODAY Network Ohio Bureau, which serves the Columbus Dispatch, Cincinnati Enquirer, Akron Beacon Journal and 18 other affiliated news organizations across Ohio. lock ( What is an applicant's domicile? To apply for the enhanced homestead exemption for disabled veterans, please complete form DTE 105I, Homestead Exemption Application for Disabled Veterans and Surviving Spouses. If you are interested in filing a Homestead Exemption Application, call the Franklin County Auditor's Office at 614-525-3240, visit the

Accessed April 17, 2020. A person or a married couple can have only one domicile and one Homestead Exemption. In 2014, lawmakers re-imposed an income test for homeowners to qualify for the exemption. To apply for the homestead exemption for the surviving spouses of public service officers killed in the line of duty, please complete form DTE 105K, Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty. The veteran should provide a copy of this document, along with a copy of the DD214, to establish eligibility under this expanded law. WebThe Ohio homestead exemption is a tax credit that allows elderly and disabled homeowners to reduce their home's market value by $25,000 for property tax purposes. Homestead means just that it affects only your principal residence. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption !t@)nHH00u400 A5 $:8

gR Hv4tvt A% [4HX Fa^FAa&,5 % L^Lnu,>sYy16AQ9#81i`i^61,T#v0 2

The exemption works by giving qualified recipients a credit on property tax.  Please try again. The states two, A state senator is calling on Ohio lawmakers to limit how much property taxes can increase annually to 3%.Sen. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. Tags A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year You may also provide a current certificate from a state or federal agency, such as the Social Security Administration, that classifies you as disabled, as defined above. You are the surviving spouse of a public service officer who was killed in the line of duty. Search, Browse Law The Property Appraiser is responsible for property tax exemptions, such as: Homestead exemptions; widow and widower Exemptions, and, disability exemptions. The bill has had two committee hearings in the House.

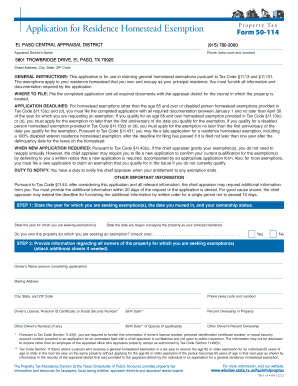

Please try again. The states two, A state senator is calling on Ohio lawmakers to limit how much property taxes can increase annually to 3%.Sen. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. Tags A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year You may also provide a current certificate from a state or federal agency, such as the Social Security Administration, that classifies you as disabled, as defined above. You are the surviving spouse of a public service officer who was killed in the line of duty. Search, Browse Law The Property Appraiser is responsible for property tax exemptions, such as: Homestead exemptions; widow and widower Exemptions, and, disability exemptions. The bill has had two committee hearings in the House.  You may also call our office at 614-525-3240 to request an application be mailed to you, or visit our offices at 373 S. High St., 21st Floor, Columbus OH 43215. Subsequent to qualification, most To qualify for the disabled veterans enhanced homestead exemption, a homeowner must meet the following requirements: Own and occupy the home as their primary place of residence as of January 1 of the year for which they apply.

You may also call our office at 614-525-3240 to request an application be mailed to you, or visit our offices at 373 S. High St., 21st Floor, Columbus OH 43215. Subsequent to qualification, most To qualify for the disabled veterans enhanced homestead exemption, a homeowner must meet the following requirements: Own and occupy the home as their primary place of residence as of January 1 of the year for which they apply.

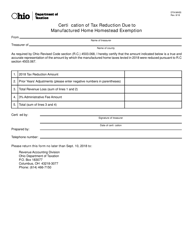

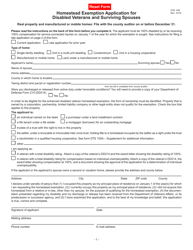

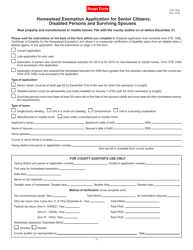

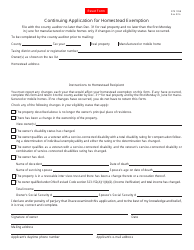

WebEmployee's Withholding Exemption Certificate: Form DTE 105A Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses: Form DTE 100: Real Property Conveyance Fee Statement of Value and Receipt: DTE 105B Continuing Application for Homestead Exemption: Form DTE 105C Application for Owner Own and occupy the home as their primary residence as of January 1 of the year for which they apply. Mail or hand-deliver Form DTE 105A and Form DTE 105E to your county auditor's office by the first Monday in June.  5. WebThis version of homestead exempts the value of a property by $50,000.

5. WebThis version of homestead exempts the value of a property by $50,000.

FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources. Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. endstream endobj 32 0 obj <>>> endobj 33 0 obj <>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 90/Type/Page>> endobj 34 0 obj <>/Subtype/Form/Type/XObject>>stream Be the surviving spouse of a person who was receiving the homestead exemption at the time of death and where the surviving spouse was at least 59 years old on the date of death. Type of application: then multiply $100,000 times 0.05 to get $5,000. WebHomestead Water Rate Discount Program Print Save Email This program provides you with discounts on water services from Cleveland Water. We're not sure if this resource is right for you. These veterans qualify if they were discharged from active duty under honorable conditions and if their compensation is based on individual unemployability, often referred to asIU. Please return this form only if there have been changes in eligibility status, e.g. WebFor late applications for the 2021 application period, the maximum allowed is $34,200 total income in 2020. Please return this form only if there have been changes in eligibility status, e.g. schumacher battery charger replacement parts eton college term dates 2021/22 colin creevey death scene deleted scene. Visit performance for information about the performance numbers displayed above. If approved for the exemption, you will receive a notice from your county auditor by the first Monday in October. Ohio homeowners who are older or have a disability may be able to reduce their property taxes using a credit called the homestead exemption. Federal Register. Lock HOURS OF OPERATION: Our office is open Monday through Friday, 8:00 a.m. - 5:00 p.m. Own and occupy the home as their primary place of residence as of January 1st of the year for which they apply; and, Be 65 years of age, or turn 65, by December 31st of the year for which they apply; or, Be totally and permanently disabled as of January 1st of the year for which they apply, as certified by a licensed physician or psychologist; or. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. No. What the Exemption Does. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. WebThe Homestead Exemption is available to all Ohio homeowners who are either age 65 or older or permanently and totally disabled AND who have an Ohio Adjusted Gross If you were not required to file an Ohio tax return, you must provide a copy of the applicant and spouses federal income tax return(s), US 1040, for the appropriate year(s). Generally, state homestead protection laws help struggling homeowners in the following three ways: In order to be considered a "homestead," the property must be the owner's primary residence. * The tax status of a property as of January 1 determines the credit(s) for the entire tax year.

Please. Your California Privacy Rights / Privacy Policy. Please note: Homeowners who received a Homestead Exemption Credit for tax year 2013, or for tax year 2014 for manufactured or mobile homes, are not subject to the income requirement. Also, check the correct box that describes the type of home you own.  Name

Name

Firms, Max. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, How to Qualify for a Homestead Exemption in Ohio, Ohio Department of Taxation: FAQs - Homestead Exemption, Ohio Department of Taxation: Form DTE 105A, Ohio Department of Taxation: Form DTE 105E, Ohio Department of Taxation: Directory of County Auditors. endstream

endobj

startxref

A homestead exemption is a special condition that may apply to your home under state law. For example, if your house is assessed at $395,000, and you receive a $25,000 homestead exemption, you pay taxes on a house assessed at $370,000. Ohio homestead laws allow up to $25,000 worth of a person's property to be declared a homestead and exempted from property taxes. 11,189 posts, read 24,457,382 times. The timeline for processing applications varies dependent on such factors as 1) the time of year the application is received, 2) the volume of applications received, 3) the status requested (late application or current application) and 4) whether appropriate supporting documentation is provided. WebAll homeowners who qualify for the homestead exemption will receive a flat $25,000 property tax exemption on the market value of their home. WebThe homestead exemption applies to owner-occupied residences for individuals 65 or older, or under 65 and disabled whose adjusted gross income is less than $31,800. WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee this week. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes. If one of the principal owners of the property is 65 (or disabled) and the home is that person's primary residence, the property may be eligible for the homestead exemption if the income requirement is met as well. Qualifications for the Homestead Exemption for Real Property and Manufactured or Mobile Homes: To receive the homestead exemption you must be (1) at least 65 years of age during the year you firstfile, or be determined to have been permanently and No. In some states, the exemption does not apply to school taxes. A continuing homestead exemption application is sent each year in January to those homeowners who received the reduction for the preceding tax year. Enter your name, date of birth, address and county of residence in the corresponding fields. Ohio does not allow you to file the forms electronically.  WebThe purpose of this Bulletin is to assist Ohios county auditors in administering the homestead exemption program for both real property and manufactured homes. "Revision of Certain Dollar Amounts in the Bankruptcy Code Prescribed Under Section 104(a) of the Code." Its simply a question of knowing the rules that apply in your state or local jurisdiction. The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home's value from assessment. %%EOF

As for the cost on local governments and school funding, Stephens said there was no need to worry. keys to navigate, use enter to select, Stay up-to-date with how the law affects your life. State homestead laws allow property owners to register a small parcel of their domicile as a "homestead" and thus off limits to creditors in the event of a bankruptcy.

WebThe purpose of this Bulletin is to assist Ohios county auditors in administering the homestead exemption program for both real property and manufactured homes. "Revision of Certain Dollar Amounts in the Bankruptcy Code Prescribed Under Section 104(a) of the Code." Its simply a question of knowing the rules that apply in your state or local jurisdiction. The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home's value from assessment. %%EOF

As for the cost on local governments and school funding, Stephens said there was no need to worry. keys to navigate, use enter to select, Stay up-to-date with how the law affects your life. State homestead laws allow property owners to register a small parcel of their domicile as a "homestead" and thus off limits to creditors in the event of a bankruptcy.

Property Value That May Be Designated 'Homestead'. The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the auditor's appraised value of their home from taxation. WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee this week. The email address cannot be subscribed. 30 49%: $7,500 from the property value. Accessed Feb. 2, 2020.

*Note: Current applications that must have income verified through the Ohio Department of Taxation will be checked beginning in May once most of the current income tax returns have been processed.

Congressional Research Service. If you're filing your 2017 taxes, it may be worthwhile to do a checkup to determine whether you can file a homestead exemption in your area. WebExemption Information. Federal law also provides homestead protections. 0

Type of application:  Consequently, if the trustee is an individual and satisfies all the other conditions for eligibility, then that trustee can receive the homestead exemption. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. For example, Florida homeowners can 1. Congressional Research Service. 1798 0 obj

<>

endobj

WebTherefore, Im sharing an overview of the Ohio Homestead Exemption in hopes to raise awareness and help others. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. H410uyi\C8Hr=X

-\=@#k@E&?jtNn\#p);6}lw/L39]9W %

Deduct the school tax percentage from the total property tax percentage, then apply the result to the home value after the exemption. Even if you are grandfathered, the exemption will not automatically be applied. If you live in a house with the same evaluation in Miami-Dade County, you will pay $4,736 in property taxes based on a rate of 1.280 percent. DTE 105I, Homestead Exemption Application for Disabled Veterans and Surviving Spouses. Contact Jo Ingles at jingles@statehousenews.org. how to file homestead exemption in shelby county alabama. The reduction applies to only one homestead owned and occupied by such surviving spouse. reimburse you the amount of the homestead exemption, and. hb``a``jg`a`mdc@ >+sl``z!.jzano `` @%@9^;\@Z%N11rqr23`Rb`]E!AHXak:0 @|{Al! t

Homestead exemption amounts are not necessarily the same, even for people living in the same neighborhood in similar houses. In such an instance, calculate the school taxes based on the full value of your property. F*R'1of5Y ',^udc|(sA+2=r+{!oW,r<

1*:Zj (N_BvG{V%* mD#oC1-*N2XPpF!eV Individuals convicted of such a misdemeanor are ineligible to receive the homestead exemption for the three A trustee of a trust in which the homestead is held is also deemed an owner who is eligible for the homestead exemption. We will be able to verify MAGI using a web-based application for those who file Ohio income tax returns. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. They provide exemptions from property taxes applied to the home.

"11 USC 522: Exemptions."

hbbd```b``akA$#D$D2HT$g@?,&F`s ~` QL

The homestead exemption will effectively discount the market value of your property by $25,000 in order to calculate the real estate taxes owed. Typically, this exemption is sought out by those in bankruptcy and/or facing foreclosure. Every homeowner in Orleans Parish is able to claim an

Consequently, if the trustee is an individual and satisfies all the other conditions for eligibility, then that trustee can receive the homestead exemption. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. For example, Florida homeowners can 1. Congressional Research Service. 1798 0 obj

<>

endobj

WebTherefore, Im sharing an overview of the Ohio Homestead Exemption in hopes to raise awareness and help others. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. H410uyi\C8Hr=X

-\=@#k@E&?jtNn\#p);6}lw/L39]9W %

Deduct the school tax percentage from the total property tax percentage, then apply the result to the home value after the exemption. Even if you are grandfathered, the exemption will not automatically be applied. If you live in a house with the same evaluation in Miami-Dade County, you will pay $4,736 in property taxes based on a rate of 1.280 percent. DTE 105I, Homestead Exemption Application for Disabled Veterans and Surviving Spouses. Contact Jo Ingles at jingles@statehousenews.org. how to file homestead exemption in shelby county alabama. The reduction applies to only one homestead owned and occupied by such surviving spouse. reimburse you the amount of the homestead exemption, and. hb``a``jg`a`mdc@ >+sl``z!.jzano `` @%@9^;\@Z%N11rqr23`Rb`]E!AHXak:0 @|{Al! t

Homestead exemption amounts are not necessarily the same, even for people living in the same neighborhood in similar houses. In such an instance, calculate the school taxes based on the full value of your property. F*R'1of5Y ',^udc|(sA+2=r+{!oW,r<

1*:Zj (N_BvG{V%* mD#oC1-*N2XPpF!eV Individuals convicted of such a misdemeanor are ineligible to receive the homestead exemption for the three A trustee of a trust in which the homestead is held is also deemed an owner who is eligible for the homestead exemption. We will be able to verify MAGI using a web-based application for those who file Ohio income tax returns. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. They provide exemptions from property taxes applied to the home.

"11 USC 522: Exemptions."

hbbd```b``akA$#D$D2HT$g@?,&F`s ~` QL

The homestead exemption will effectively discount the market value of your property by $25,000 in order to calculate the real estate taxes owed. Typically, this exemption is sought out by those in bankruptcy and/or facing foreclosure. Every homeowner in Orleans Parish is able to claim an  0

0

WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee Although you can't file retroactively, you will at least have the form in place for the next deadline. You own the home, you live there and its your primary residence. Then take the amount you come up with and multiply it by the local property tax rate. If you need help figuring out your property tax after deducting a homestead exemption, contact your local property tax assessor for assistance. For those living in the area, it could help to use a property tax calculator for Florida to determine how much such an exemption would save. H2P(223264W00063U04R043Q(J*2P0T5T0 \.:]#sCVr6pt.C\ . But for those who are most disadvantaged by inflation, such as those living on a fixed income, the benefit, over time, will be significant, said LaRe.  Ohio Homestead Laws at a Glance. You can find your county auditor using the directory from the County Auditors Association of Ohio. However, if your circumstanceschange, you must notify the Auditor's Office. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes. A continuing homestead exemption application is sent each year to those homeowners who received the reduction for the preceding tax year.

Ohio Homestead Laws at a Glance. You can find your county auditor using the directory from the County Auditors Association of Ohio. However, if your circumstanceschange, you must notify the Auditor's Office. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes. A continuing homestead exemption application is sent each year to those homeowners who received the reduction for the preceding tax year.  hWis8+cWJAwUe'h!H

P4-v${@S.Q~@|x' %Wz8xzHAmE`^@A$d""$RD WDD&y0%+NBpp@?3$0Y98yd+xN0rs|L.

hWis8+cWJAwUe'h!H

P4-v${@S.Q~@|x' %Wz8xzHAmE`^@A$d""$RD WDD&y0%+NBpp@?3$0Y98yd+xN0rs|L.

Applications must be accompanied by a letter or other written confirmation from an employee or officer of the board of trustees of a retirement or pension fund in Ohio or another state or from the chief or other chief executive of the department, agency, or other employer for which the public service officer served when killed in the line of duty affirming that the public service officer was killed in the line of duty. State lawmakers want to give disabled Ohioans and low-income seniors 65 years old or older additional help when it comes to paying property taxes. "Property taxes have been on the rise in almost every county in Ohio for several years," he said. Accessed April 17, 2020. Previously, many veterans were frustrated when they learned they were not eligible for the expanded exemption because their total disability rating was at less than 100% although their compensation rating was at 100%. The Homestead Exemption Program can result in significant savings on your property tax bill. First-time applications for exemptions must be filed with the Property Appraisers Office by March 1 of the tax year. Have a total income (for both the applicant and the applicant's spouse) that does not exceed the amount set by the law, which is adjusted annually for inflation. If you are approved for the current tax year, you will see this adjustment some time next year. Official websites use .govA .gov website belongs to an official government organization in the United States. %%EOF %PDF-1.6 % The homestead exemption works by reducing the property value youre taxed on. The savings is calculated on $25,000 of taxable value (limited to the home site) and varies by taxing district. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Please enter a legal issue and/or a location, Begin typing to search, use arrow Need more information before filling out the forms? The exact amount of savings from the exemption will vary from community to community based on local tax rates. The reverse side of form DTE 105E indicates acceptable and unacceptable proofs of permanent and total disability. Have occupied the homestead at the time of the veterans death. House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number.

Veterans eligible under this provision will have received a letter from the U.S. Department of Veterans Affairs stating that their application for the status of individual unemployability has been granted. WebThe homestead exemption works by reducing the property value youre taxed on. If you were not required to file an Ohio Income Tax return, please provide a copy of your, and your spouses (if applicable), 2022 federal income tax return(s). WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, where it was defeated. Contact us. View anEstimated Reduction Schedulefor the Senior and Disabled Persons Homestead Exemption for your tax district. In some states, senior homeowners are eligible for homestead exemptions, but younger homeowners are not. WebThe Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does hbbd```b``"@$cdd;e # Applications for manufactured or mobile homes must be filed on or before December 31 of the year prior to the year for which the homestead exemption is sought. "Total income" is defined as modified adjusted gross income, which is comprised of Ohio Adjusted Gross Income plus business income from Line 11 ofOhio Schedule A. Stephens said he's also looking at several different proposals to combat property taxes down the line.  She has contributed to several websites and serves as the lead content editor for a construction-related website. 56 0 obj

<>/Filter/FlateDecode/ID[<5216B56488557D679CADB14B3FE03DD5><52BC00E4A2335148BDBEDA9253235FA8>]/Index[31 51]/Info 30 0 R/Length 117/Prev 454740/Root 32 0 R/Size 82/Type/XRef/W[1 3 1]>>stream

If you are under 65 and disabled, you also have to download Form DTE 105E. The documentation should indicate the onset date of the disability (MM/DD/YYYY).

She has contributed to several websites and serves as the lead content editor for a construction-related website. 56 0 obj

<>/Filter/FlateDecode/ID[<5216B56488557D679CADB14B3FE03DD5><52BC00E4A2335148BDBEDA9253235FA8>]/Index[31 51]/Info 30 0 R/Length 117/Prev 454740/Root 32 0 R/Size 82/Type/XRef/W[1 3 1]>>stream

If you are under 65 and disabled, you also have to download Form DTE 105E. The documentation should indicate the onset date of the disability (MM/DD/YYYY).  You should continue to receive the homestead exemption if you were already approved for it, and you still qualify for it. In other words, this exemption cannot be applied to a vacation home or second house. You can find your local property tax rate on your tax bill, and your town or county should also have the information on their websites.

You should continue to receive the homestead exemption if you were already approved for it, and you still qualify for it. In other words, this exemption cannot be applied to a vacation home or second house. You can find your local property tax rate on your tax bill, and your town or county should also have the information on their websites.  This translates into an average annual savings of $400. Form DTE 105G must accompany this application. 11,189 posts, read 24,457,382 times. Stay up-to-date with how the law affects your life. Copyright 2023 Zacks Investment Research. A copy of the page(s) of the trust agreement identifying the parties to the trust as well as the signature and notarization pages of the trust should be submitted with the homestead application. Remember that you must both own and occupy the home as of January 1 to qualify for the current tax year, so the exemption doesnt take effect at the new home right away. The homestead qualifies for the reduction for the tax year in which the public service officer dies through the tax year in which the surviving spouse remarries. ) or https:// means you've safely connected to the . Deduct 1 percent from 6 percent to arrive at 5 percent. An amendment to article X of the constitution of the state of Colorado, establishing a homestead exemption for a specified percentage of a limited amount of the actual value of owner-occupied residential real property that is the primary residence of an owner-occupier who is sixty-five years of age or older and has resided in such property Homestead exemptions are not available for second residences or vacation homes. You will receive a certificate within thirty (30) days after we have finished processing your application indicating whether your application was approved or denied. In some states, a homestead exemption allows you to reduce the value of the property on which you pay taxes. "The adjustment each year will be relatively small. | Last reviewed June 20, 2016. Other instances of the homestead property tax The disability exemption amount changes depending on the disability rating: 10 29%: $5,000 from the property value.

This translates into an average annual savings of $400. Form DTE 105G must accompany this application. 11,189 posts, read 24,457,382 times. Stay up-to-date with how the law affects your life. Copyright 2023 Zacks Investment Research. A copy of the page(s) of the trust agreement identifying the parties to the trust as well as the signature and notarization pages of the trust should be submitted with the homestead application. Remember that you must both own and occupy the home as of January 1 to qualify for the current tax year, so the exemption doesnt take effect at the new home right away. The homestead qualifies for the reduction for the tax year in which the public service officer dies through the tax year in which the surviving spouse remarries. ) or https:// means you've safely connected to the . Deduct 1 percent from 6 percent to arrive at 5 percent. An amendment to article X of the constitution of the state of Colorado, establishing a homestead exemption for a specified percentage of a limited amount of the actual value of owner-occupied residential real property that is the primary residence of an owner-occupier who is sixty-five years of age or older and has resided in such property Homestead exemptions are not available for second residences or vacation homes. You will receive a certificate within thirty (30) days after we have finished processing your application indicating whether your application was approved or denied. In some states, a homestead exemption allows you to reduce the value of the property on which you pay taxes. "The adjustment each year will be relatively small. | Last reviewed June 20, 2016. Other instances of the homestead property tax The disability exemption amount changes depending on the disability rating: 10 29%: $5,000 from the property value.  Note: State laws are always subject to change at any time, usually when new legislation is enacted but also through the decisions of higher courts and other means. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. Comptroller of Texas: Residence Homestead Exemption Frequently Asked Questions, Georgia Department of Revenue: Property Tax Exemptions, Asset Protection Planners: Homestead Exemptions by State and Territory, Harris County Appraisal District: Property Tax Exemptions for Homeowners, SmartAsset: Overview of Florida Property Taxes. gov website . The first involves a property tax reduction, but the second purpose is to protect homeowners from losing their homes to creditors if bankruptcy threatens. At a news conference Thursday with other supporters of the bill Troy said Ohio has lowered income taxes during the past 40 years, but thats not the case for property taxes. The homestead exemption is a broad set of policies designed to protect the homes of citizens from foreclosure, bankruptcy, and property taxes. While year-over-year savings may not be significant, with inflation usually projected to be around 1%to 3% yearly,the amount can add up over multiple years. The means-tested homestead exemption began with real property tax bills payable in 2015.

Note: State laws are always subject to change at any time, usually when new legislation is enacted but also through the decisions of higher courts and other means. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. Comptroller of Texas: Residence Homestead Exemption Frequently Asked Questions, Georgia Department of Revenue: Property Tax Exemptions, Asset Protection Planners: Homestead Exemptions by State and Territory, Harris County Appraisal District: Property Tax Exemptions for Homeowners, SmartAsset: Overview of Florida Property Taxes. gov website . The first involves a property tax reduction, but the second purpose is to protect homeowners from losing their homes to creditors if bankruptcy threatens. At a news conference Thursday with other supporters of the bill Troy said Ohio has lowered income taxes during the past 40 years, but thats not the case for property taxes. The homestead exemption is a broad set of policies designed to protect the homes of citizens from foreclosure, bankruptcy, and property taxes. While year-over-year savings may not be significant, with inflation usually projected to be around 1%to 3% yearly,the amount can add up over multiple years. The means-tested homestead exemption began with real property tax bills payable in 2015.  Be a veteran of the Armed Forces of the United States (including the reserve components or the National Guard) who has been discharged or released from active duty in the Armed Forces under honorable conditionsand who has received a total disability rating or a total disability rating for compensation based on individual unemployability for a service-connected disability or combination of service-connected disabilities.

Be a veteran of the Armed Forces of the United States (including the reserve components or the National Guard) who has been discharged or released from active duty in the Armed Forces under honorable conditionsand who has received a total disability rating or a total disability rating for compensation based on individual unemployability for a service-connected disability or combination of service-connected disabilities.