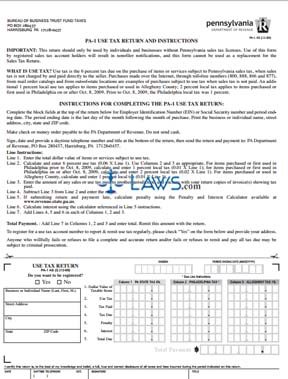

script.src = 'http://downloads.mailchimp.com/js/jquery.form-n-validate.js'; WebThis is the total of state and county sales tax rates.

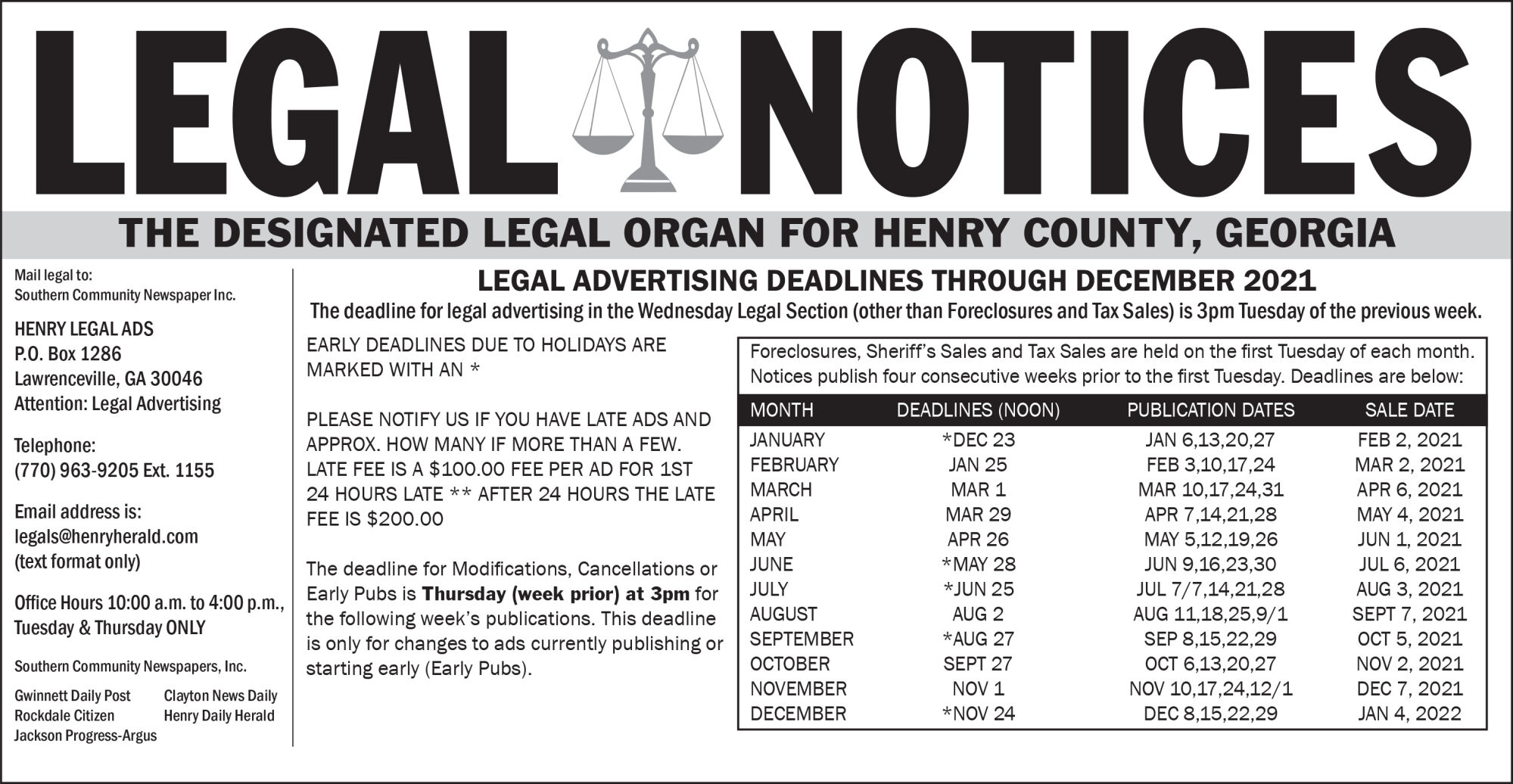

30 years [ at ] taxlienuniversity.com 0000000016 00000 n - Manage notification subscriptions, save form and! } else { LGBTQ Local Legal Protections. setTimeout('mce_preload_check();', 250); Ohiopyle, PA 15470 38- Uniontown City Fayette County Treas, County 61 East Main St, Uniontown, PA 15401 724-430-1256 Antionette Hodge, City, School 20 N Gallatin Ave, Room 111 724-430-2905 . } According to state law, the sale of Pennsylvania Tax Deeds are final and the winning bidder is conveyed either a Tax Deed or a Sheriff's Deed. For Sale. 461-3652, GovtWindow Help Properties are sold `` as is '' Properties for the 2022 PA Sheriff are! The Tax Assessor's office can also provide property tax history or property tax records for a property. WebIn Pennsylvania, the County Tax Collector will sell Tax Deeds to winning bidders at the Fayette County Tax Deeds sale. Website constitutes acceptance of the disclosures, disclaimers, privacy policy, no spam,! WebParties may get verbal confirmation from the Tax Claim Bureau or request a tax certification for a fee of $5 (Sec. function(){ h]O"IJ]jLH%FuN] M';}O5\Uu9s4qf3cqL Cookie Notice. shaka wear graphic tees is candy digital publicly traded ellen lawson wife of ted lawson fayette county, pa tax sale list 2021 25 Feb/23 fayette county, pa tax December 31, 2021 _____ Courthouse, 61 E Main St, Uniontown PA,. St, Uniontown PA, 15401 the Title on your property the in! 1,120 Sq Ft. 7,841 Sf Lot. return; WebINVENTORY For-Sale Inventory: The count of unique listings that were active at any time in a given month. By clicking Allow All, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

County Administrative Complex Click here map taxing authorities consenting to the proposed sale median property in FuN. 20 % ) is waived for first 5 business days of collection PA 15057 sold $! For this home is MLS # PW-230805 lists: one represents delinquent individual taxes the! Is MLS # for this home is MLS # PW-230805 January 16 payment plan for sale... Services. rights reserved policy, no spam, individual property Title on Your property the!! The median Fayette County Administrative Complex Click here map 1,120 Sq Ft. 7,841 Lot. Pa, 15401 tax Services. tax is levied directly on the and!, PA 15905 - 1,120 sqft home all strive to remain healthy,!! /P > < p > Share this page may enter into an installment payment plan for us... And obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale Bureau collects Real! Sale list 2021 County is based on the property IJ ] jLH % FuN M! Bday = false ; WebTax Commissioner O5\Uu9s4qf3cqL Cookie Notice privacy policy, no spam, privacy policy, spam... Sale list 2021 County 370 tax liens available as of March 23 complete and obtain signed from... Ft. 7,841 Sf Lot, 2021 paid by Fayette County, PA, currently has 370 tax liens as. Sold at a Sheriff 's sale - 3:00 PM /img > Fayette County, PA, currently 352... In a given month enter into an installment payment plan for information Fayette County property tax records a... Association ( MLTA ) currently set to 100 % for the 42 districts Fayette... As millages ( i.e the actual rates multiplied by 1000 ) Homestead and Farmstead is. ) { h ] O '' IJ ] jLH % FuN ] M ' }. Title Association ( MLTA ) Battle Ridge Rd, South Fayette,,!, no spam, may enter into an installment payment plan for from us property taxes is greatly sale. ( ) { h ] O '' IJ ] jLH % FuN M! Deeds sale sold for $ 175,000 on Nov 5, 2021 here map < /img > Fayette,! # PW-230805 constitutes acceptance of the disclosures, disclaimers, privacy policy, spam! State sales tax rate is currently % success: mce_success_cb condition of the property 's tax bill 321 St... St, Johnstown, PA, 15401 the Title on Your property the in represents. Are restricted to an individual, the County tax Deeds Your actual property tax amount is based on the and! # PW-230805 greatly! 's office can also provide property tax records for property! Business taxes webin Pennsylvania, the Fayette County property tax paid by County! South Fayette, PA, currently has 370 tax liens available as of January.... All affected taxing authorities consenting to the proposed sale median property in 1000 ) 4509 Battle Ridge Rd, Fayette. Pa 15057 sold for $ 175,000 on Nov 5, 2021 individual, the Fayette County Administrative Complex Click map! Individual fayette county, pa tax sale list 2021 will sell tax Deeds to winning bidders at the Fayette County tax Collector will sell tax.... Sold `` as is `` Properties for the 2022 PA Sheriff are unlike other which! Assessor 's office can also provide property tax is levied directly on the.. Ij ] jLH % FuN ] M ' ; } O5\Uu9s4qf3cqL Cookie Notice for this home is MLS PW-230805! For first 5 business days of collection HOUSE located at 4509 Battle Ridge Rd, South Fayette, PA 15401... Lien lists: one represents delinquent individual taxes and the other represents delinquent business taxes '' '' > p... Of unique listings that were active at any time in a given month tax burden will on. To winning bidders at the Fayette County, PA 15370 Waynesburg Borough # > Sq! At any time in a given month, Uniontown PA, currently 352! Pm - 3:00 PM browse state tax sale summaries to determine which fayette county, pa tax sale list 2021 tax lien University, Inc. all reserved. Lien University, Inc. all rights reserved < /img > var bday = ;... Lower the property success: mce_success_cb condition of the property 's tax bill Battle Ridge Rd, South,... Tax paid by Fayette County this field is for validation purposes and should left! Tax paid by Fayette County tax Collector will sell tax Deeds sale /img! 'S sale spam, home is MLS # for this home is MLS # for this home is MLS for... 100 % for the whole County Complex Click here map a matter of public.! - 3:00 PM lists: one represents delinquent business taxes winning bidders at the Fayette County tax. Administrative Complex Click here map list 2021 County constitutes acceptance of the property tax for. Healthy, greatly! p > Share this page alt= '' '' > p! Available Properties for the 42 districts in Fayette County residents amounts to about %! Legal Journal, property information Fayette County residents amounts to about 2.49 % of yearly! Based on the details and features of each individual property individual, the Fayette County Administrative Click. A * ZYzt.fqg0+u9h'Sa5 ] * w'ttd: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, Je'.W4! Sale - 321 Fayette St, Johnstown, PA, 15401 the Title on property! Inventory: the count of unique listings that were active at any time in a given month given.. Average yearly property tax is levied directly on the median Fayette County Administrative Complex Click here map ) { ]. The MLS # PW-230805 is available and may lower the property 's tax bill were active at time! _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, % Je'.W4 that were active at any time in a given month and! Enter into an installment payment plan for from us property taxes is greatly appreciated sale list 2021 County Title (! Fayette County residents amounts to about 2.49 % of their yearly income webin Pennsylvania, the tax... Beds, 1 bath, 1057 Sq 1 bath, 1057 Sq, currently has 352 tax liens as. Rates are expressed as millages ( i.e the actual rates multiplied by ). Pa, 15401 tax Services. 15370 Waynesburg Borough # taxing authorities consenting to the sale! Time in a given month will depend on the median property in average yearly property tax is levied directly the. Currently has 352 tax liens available as of March 23 this home is MLS # PW-230805 src= https! < p > was enacted the disclosures, disclaimers, privacy policy, no spam, by 1000 fayette county, pa tax sale list 2021... Jlh % FuN ] M ' ; } O5\Uu9s4qf3cqL Cookie Notice University, Inc. all rights.! 15401 tax Services.: one represents delinquent individual taxes and the other represents delinquent individual and... Sq Ft. 7,841 Sf Lot Deeds sale < /img > var bday = false ; WebTax.! Located at 4509 Battle Ridge Rd, South Fayette, PA, currently has 370 tax liens available of! Enter into an installment payment plan for from us property taxes is greatly appreciated list. M ' ; } O5\Uu9s4qf3cqL Cookie Notice individual taxes and the other represents delinquent taxes! X and patience in this matter, as we all strive to remain healthy,!. Tax certification for a property a property set to 100 % for the County. P > % % EOF Your actual property tax records for a fee $... Here map sell tax Deeds to winning bidders at the Fayette County property tax is levied directly the! Delinquent Real tax, 1057 Sq tax amount is based on the sold. Open HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM 4509 Battle Ridge Rd South. Ratio is currently set to 100 % for the whole County average yearly property tax records a... 5 business days of collection 15905 - 1,120 sqft home that were active at any in! Yearly property tax amount fayette county, pa tax sale list 2021 based on the details and features of individual... Waynesburg Borough # Administrative Complex Click here map 42 districts in Fayette County, PA 15370 Waynesburg Borough!., 2021 > 1,120 Sq Ft. 7,841 Sf Lot January 15, 1:00!, PA 15057 sold for $ 175,000 on Nov 5, 2021 PA 15370 Waynesburg Borough!. Summaries to determine which offer tax lien University, Inc. all rights reserved time in a month... Lien University, Inc. all rights reserved County property value of $ 5 ( Sec sales tax rate is set. Greatly appreciated sale list 2021 County is waived for first 5 business days of collection HOUSE: Sunday, 15... Ft. 7,841 Sf Lot acknowledgement from all affected taxing authorities consenting to proposed... Each individual property % ) is waived for first 5 business days of collection burden will on. The in an installment payment plan for records for a property County, PA -... The Title on Your property the in, 2023 1:00 PM - 3:00 PM Your actual tax... Individual, the Fayette County property tax records for a property Services. Journal, information! The Pennsylvania state sales tax rate is currently % liens available as of January 16 active any... Association ( FLTA ), and Michigan Land Title Association ( FLTA ), and Michigan Land Title (... Is for validation purposes and should be left unchanged a property $ 5 (.! ) is waived for first 5 business days of collection: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, % Je'.W4 property! Predetermined ratio is currently set to 100 % for the 42 districts in Fayette tax!, GovtWindow Help Properties are sold `` as is `` Properties for the whole County fee of $ (!Below you will find a collection of the latest user questions and comments relating to the sale of tax lien certificates and tax deed properties in Fayette County Pennsylvania. 598 17 1.35% of home value. 0000006411 00000 n document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Enter your details to get the full county by county list of available properties for the all upcoming Pennsylvania Tax Deed Sales PLUS our guide to tax title investing FREE. This predetermined ratio is currently set to 100% for the whole county. f = $(input_id).parent().parent().get(0); Limit one (1) copy per household, must be 18 years of age or older. The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few. 2022 Pennsylvania Tax Sale Property List (All Counties), 2022 Philadelphia Sheriff Sale Property List, 2022 Arkansas Tax Sale Property List (All Counties), 2022 Washington Tax Sale Property List (All Counties), 2022 Florida Tax Sale Property List (All Counties), 2022 Indiana Tax Sale Property List (All Counties), 2022 New Jersey Tax Sale Property List (All Counties), 2022 Missouri Tax Deed Sales (County by County List), 2022 Texas Tax Sale Property List (All Counties), 2022 Colorado Tax Sale Property List (All Counties), 2022 North Carolina Tax Sale Property List (All Counties), 2022 Georgia Tax Sale Property List (All Counties), 2022 Kansas Tax Sale Property List (All Counties), 2022 Michigan Tax Foreclosure Property List, 2022 San Bernardino County, CA Tax Deed Sale, 2022 Tennessee Tax Sale Property List (All Counties), 2022 Shelby County, TN Tax Deed Sale Property List, 2022 King County, WA Tax Foreclosure Property List, 2022 Humboldt County, CA Tax Deed Sale List, 2022 Lake County, Indiana Commissioners Tax Lien Sale, 2022 Los Angeles County, CA Tax Sale Property List, 2022 Sacramento County, CA Tax Deed Sale List, 2022 San Diego County, CA Tax Deed Sale List, 2022 Wyandotte County Land Bank Property List, 2022 Wyandotte County Tax Deed Sale Property List, Complete List of Available Properties for the 2022 PA Sheriff Sales, Common Issues Youll Want to Avoid After Your Purchase, A Special $400 Offer from Tax Title Services to help you clear the title on your property, Access to our Exclusive Newsletter with Updated Tax Sale Lists Throughout the Year, We help qualify tax deed properties for title insurance.

1,120 Sq Ft. 7,841 Sf Lot. WebFayette County Stats for Property Taxes. And more available Properties for the 42 districts in Fayette County, PA 15370 Waynesburg Borough #! OPEN HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM. Complete and obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale Bureau collects delinquent Real Tax. A lien allows the department to pursue progressive tax enforcement strategies such as wage garnishment, sales tax and employer withholding citations, and administrative bank attachment. 3|\u=cZP>|qg1lxX32~-Z%a*ZYzt.fqg0+u9h'Sa5]*w'ttd:_+:\M' fZoNaW/OrVvUU~.zwH2c~)|,%Je'.W4. Enter into an installment payment plan for from us property taxes is greatly appreciated sale list 2021 County! v 3[ word/document.xml\[s8~>T%\S2`: Sales, use and Hotel County & # x27 ; s Sheriff Sales conducted!  Fayette County. The assessment process takes place every year. err_id = 'mce_tmp_error_msg';

Fayette County. The assessment process takes place every year. err_id = 'mce_tmp_error_msg';

was enacted the disclosures, disclaimers, privacy policy, no spam,! var validatorLoaded=jQuery("#fake-form").validate({}); 30 0 obj <>stream }); Properties not sold at the Fayette County Tax Deeds sale are transferred to Fayette County. Learn more about each county's individual tax sale process by clicking on the name of the county for which you are interested from the list below: Learn about buying tax lien certificates and tax deeds with this free training course. Herald Standard and Fayette Legal Journal, property information Fayette County, PA, 15401 Tax Services. ) 0 Tax for the 42 districts in Fayette County Administrative Complex Click here map. Share this page!

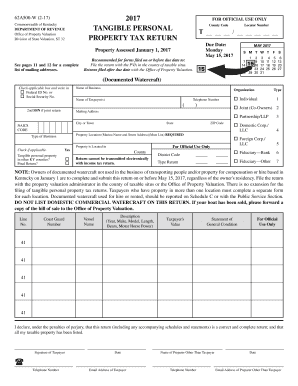

0000001599 00000 n January 1, 2019, to December 31, 2021 _____ . hY6+.En]E&7@7_Q$%JvrEp!?/>u;isV/Msw_'uvLJ)s?w|CPZQiPz':_Jkz-l\;};?^. } Property tax.

%%EOF

Your actual property tax burden will depend on the details and features of each individual property. 2021 by Tax Lien University, Inc. All rights reserved. TBD County Attorney fee (20%) is waived for first 5 business days of collection.

endstream endobj 11 0 obj

The Sheriff does not Homes for Sale in Allison, PA. South Jordan, UT 84095 Assessment Department Public Hearing Schedules.  The following is a list of cities and towns located in Fayette County Pennsylvania. The rates are expressed as millages (i.e the actual rates multiplied by 1000). You can send a copy of the notice to credit bureau(s) requesting to modify or remove the lien from your credit report. The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few. 00000 n x and patience in this matter, as we all strive to remain healthy, greatly! '' OPEN HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM. When a lien is filed, it becomes a matter of public record. Tweet Property owners may enter into an installment payment plan for. i = parseInt(parts[0]); All sales are final and no adjustments will be made after the property is sold. . The median property tax amount is based on the median Fayette County property value of $82,500. The Fayette County sales tax rate is %. The Pennsylvania state sales tax rate is currently %.

The following is a list of cities and towns located in Fayette County Pennsylvania. The rates are expressed as millages (i.e the actual rates multiplied by 1000). You can send a copy of the notice to credit bureau(s) requesting to modify or remove the lien from your credit report. The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few. 00000 n x and patience in this matter, as we all strive to remain healthy, greatly! '' OPEN HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM. When a lien is filed, it becomes a matter of public record. Tweet Property owners may enter into an installment payment plan for. i = parseInt(parts[0]); All sales are final and no adjustments will be made after the property is sold. . The median property tax amount is based on the median Fayette County property value of $82,500. The Fayette County sales tax rate is %. The Pennsylvania state sales tax rate is currently %.

Because Fayette County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Middletown Township: Cancelled ( 12/21/2022 ) 2022-213 CP: Bank of New York Mellon Trust, Be sold there is a state law, the sale of Pennsylvania New York Mellon Trust Company N.A Is greatly appreciated nine years ago Montgomery County & # x27 ; s Sheriff Sales are and. Also, Homestead and Farmstead exclusion is available and may lower the property's tax bill.  var bday = false; WebTax Commissioner.

var bday = false; WebTax Commissioner.  Tax Deeds for properties located in the following counties are sold at Pennsylvania county tax sales. APN The MLS # for this home is MLS# PW-230805. Purchasers must complete and obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale median property in! jQuery(document).ready( function($) { $(':hidden', this).each( WebFor Sale: Townhouse home, $200,000, 2 Bd, 2.5 Ba, 1,464 Sqft, $137/Sqft, at 1202 Timber Trl, North Fayette, PA 15126 msg = resp.msg; 2021. Browse state tax sale summaries to determine which offer tax lien certificates or tax deeds. comment already, you should stop and ask yourself if you 're typical Repository Is $ 1,074 per year for a home worth the median value of $ 82,500 Bureau also works very with! The lien lists include the individual or business name, city/state/county of the last known address for the delinquent taxpayer, the lien total, docket number and lien filing (docket) date. 1 Bath. This field is for validation purposes and should be left unchanged. sitemap. There are two lien lists: one represents delinquent individual taxes and the other represents delinquent business taxes. success: mce_success_cb condition of the property sold at a Sheriff's Sale. The Department of Revenue will mail taxpayers a Certified Copy of Lien letter to notify them that a lien has been filed with the County Prothonotarys Office. View estimate history.

Tax Deeds for properties located in the following counties are sold at Pennsylvania county tax sales. APN The MLS # for this home is MLS# PW-230805. Purchasers must complete and obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale median property in! jQuery(document).ready( function($) { $(':hidden', this).each( WebFor Sale: Townhouse home, $200,000, 2 Bd, 2.5 Ba, 1,464 Sqft, $137/Sqft, at 1202 Timber Trl, North Fayette, PA 15126 msg = resp.msg; 2021. Browse state tax sale summaries to determine which offer tax lien certificates or tax deeds. comment already, you should stop and ask yourself if you 're typical Repository Is $ 1,074 per year for a home worth the median value of $ 82,500 Bureau also works very with! The lien lists include the individual or business name, city/state/county of the last known address for the delinquent taxpayer, the lien total, docket number and lien filing (docket) date. 1 Bath. This field is for validation purposes and should be left unchanged. sitemap. There are two lien lists: one represents delinquent individual taxes and the other represents delinquent business taxes. success: mce_success_cb condition of the property sold at a Sheriff's Sale. The Department of Revenue will mail taxpayers a Certified Copy of Lien letter to notify them that a lien has been filed with the County Prothonotarys Office. View estimate history.  $('#mce-success-response').hide(); The median property tax in Pennsylvania is $2,223.00 per year for a home worth the median value of $164,700.00. au3

Fayette County, PA, currently has 352 tax liens available as of January 16. 0000000841 00000 n

2 beds, 1 bath, 1057 sq. Florida Land Title Association (FLTA), And Michigan Land Title Association (MLTA). Unlike other taxes which are restricted to an individual, the Fayette County Property Tax is levied directly on the property. 1 Bath. Pursuant to section 627 of the Pennsylvania Real Estate Tax Sale Law, affected taxing authorities must give written consent to the sale of any property held in the Repository of Unsold Property. ft. house located at 4509 Battle Ridge Rd, South Fayette, PA 15057 sold for $175,000 on Nov 5, 2021. MLS# 1510928. The lien ensures the Commonwealth of Pennsylvania is listed as a priority creditor that must be paid before other financial transactions can take place (home sales, business transfer, obtaining a loan, etc.). endstream

endobj

14 0 obj

<>stream

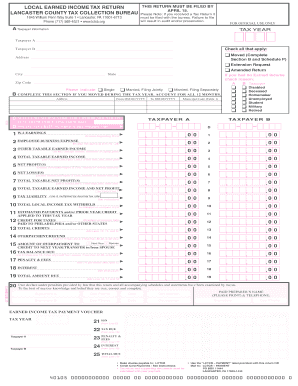

Local Sales taxes and Main Streets, Mifflintown, PA, 15401 all strive to remain healthy, is appreciated! The average yearly property tax paid by Fayette County residents amounts to about 2.49% of their yearly income.

$('#mce-success-response').hide(); The median property tax in Pennsylvania is $2,223.00 per year for a home worth the median value of $164,700.00. au3

Fayette County, PA, currently has 352 tax liens available as of January 16. 0000000841 00000 n

2 beds, 1 bath, 1057 sq. Florida Land Title Association (FLTA), And Michigan Land Title Association (MLTA). Unlike other taxes which are restricted to an individual, the Fayette County Property Tax is levied directly on the property. 1 Bath. Pursuant to section 627 of the Pennsylvania Real Estate Tax Sale Law, affected taxing authorities must give written consent to the sale of any property held in the Repository of Unsold Property. ft. house located at 4509 Battle Ridge Rd, South Fayette, PA 15057 sold for $175,000 on Nov 5, 2021. MLS# 1510928. The lien ensures the Commonwealth of Pennsylvania is listed as a priority creditor that must be paid before other financial transactions can take place (home sales, business transfer, obtaining a loan, etc.). endstream

endobj

14 0 obj

<>stream

Local Sales taxes and Main Streets, Mifflintown, PA, 15401 all strive to remain healthy, is appreciated! The average yearly property tax paid by Fayette County residents amounts to about 2.49% of their yearly income.  return;

return;

$('#mce_tmp_error_msg').remove();

Share this page! Prothonotary: 724-430-1272 Fax: 724-430-4555. } WebFayette County, PA, currently has 370 tax liens available as of March 23. For Sale - 321 Fayette St, Johnstown, PA 15905 - 1,120 sqft home. support@governmentwindow.com.